Jump To Section

- 1 Market Signals: Rising AI Investments Demand Proof of Impact in Financial Services

- 2 The Product North Star: Fewer, Better, and AI-Driven Customer Journeys

- 3 Core 2026 Product Themes that will Transform Quick Wins into Scaled Impact

- 4 High-Impact Use Cases for Visible ROI from AI in Financial Services

- 5 Execution Discipline: How to Work Like a Product Organization

- 6 Metrics That Matter: Measuring Product-Led AI ROI

- 7 Quarter-by-Quarter 2026 Roadmap for the Financial Sector

- 8 The Operational AI Risks to Watch in 2026

- 9 Three Key Financial Services Journeys Set for AI-Driven Transformation by December 2026

- 10 Final Takeaways: Successful AI Integration in Financial Services

- 11 FAQs

For the past three years, banks have invested heavily in artificial intelligence, cloud, and data modernization, yet most of that effort still sits in the proof-of-concept stage.

2026 is the year banks must move from AI talk to AI that moves the P&L. The priority is simple: Use AI, cloud, and data to lower the cost to serve, ship software faster, and create new revenue lines. The path forward will not come from more pilots but product-led execution: a clear sequence of agentic AI, cloud smart modernization, and strong data foundations, backed by governance and ROI tracking that leaders can trust.

In this article, we unfold this shift from AI as experiment to AI as product, breaking down five trends every banking product leader must act on to translate AI investment into measurable impact, and do so responsibly, scalably, and at speed.

Market Signals: Rising AI Investments Demand Proof of Impact in Financial Services

Across the industry, AI budgets are climbing, but proof of impact is now the price of admission.

While most banks are moving beyond treating AI technologies as a side project and investment is flowing in, boards and regulators are asking for proof. Impact must come with control. That means explainability, kill switches, audit trails, and a plan to scale what works while shutting down what does not.

As AI in financial services shifts from experimentation to implementation, most programs fail to move beyond small productivity wins because they do not touch the full journey.

The new benchmark for using AI tools is different, and it ties every dollar to a business lever:

- Cost to serve

- Fraud loss rate

- Average handle time

- Net revenue per customer

- Release frequency

Financial services leaders have shifted their stance from caution to conviction. A growing share of CFOs now back aggressive AI strategies and are allocating a meaningful portion of their spend to digital labor in the form of AI agents. They are widening the ROI lens beyond short term savings to include risk reduction and revenue growth. When governance is clear and outcomes are measurable, finance is ready to fund at scale.

Regulators and central banks are moving in the same direction. Supervisors are deploying AI for real time fraud detection and monitoring and payments oversight, and they expect the industry to meet the same standard. This sets a practical requirement for banks. Build AI with lineage, auditability, and reversible decisions from day one. If a model misbehaves, you should be able to stop it, explain it, and roll back its actions.

The Product North Star: Fewer, Better, and AI-Driven Customer Journeys

Banks create value when they simplify.

Make fewer and better journeys your north star. Pick a small set of customer or internal journeys that move the needle, then make them dramatically better. Tie every epic to a clear measure and baseline it. If you cannot measure it, do not build it.

Apply an AI-last rule:

- Clean the process first: remove redundant steps and rework.

- Improve data quality and instrument every handoff with event tracking and ownership.

- After the journey is stable and observable, apply artificial intelligence and AI technologies where it amplifies the result.

This disciplined sequence avoids “automating chaos,” protects customer trust, and gives leaders a clear, traceable line from investment to outcome.

To learn how to transform your financial products into growth engines, look into these 3 embedded-intelligence plays.

Core 2026 Product Themes that will Transform Quick Wins into Scaled Impact

2026 marks a pivotal year for financial institutions to shift from isolated successes to sustainable, scaled impact by integrating AI in financial services. The pressure is on to translate AI investments into measurable business outcomes that truly move the needle on cost, risk, and customer experience.

Below we explore the essential product themes that will empower financial institutions to harness AI technologies responsibly and effectively, turning promising quick wins into lasting competitive advantages. Understanding and acting on these themes is critical for any organization aiming to lead in the rapidly evolving finance industry.

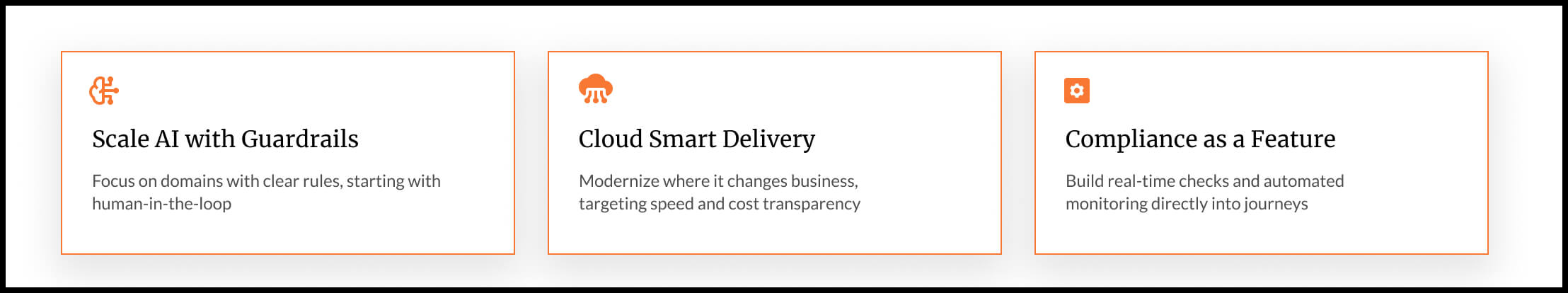

1) Scale AI Models Where Guardrails Already Exist

Start in domains with clear rules or strong patterns such as finance reconciliations, transaction anomaly detection, IT or service desk triage, and simple servicing flows. Begin with human in the loop. Prove accuracy, add confidence thresholds, and only then widen autonomy and scope. As controls prove effective, graduate to higher value areas such as intraday liquidity alerts, underwriting assistance, and claims triage, always with clear limits and fallbacks.

2) Cloud-Smart Modernization Over Cloud-First Migration

Another core theme as we move into 2026 will be cloud smart delivery, not cloud first marketing. Modernize where it changes the business. Target speed, resilience, and cost transparency rather than blanket migrations. Treat FinOps as a product capability inside engineering. Expose unit economics per journey and per feature. Know the compute and storage cost of a payment, a loan decision, or an authentication call, and show the trend line over time. Expand cost visibility to the broader technology footprint that now includes public cloud, on premises, SaaS, and AI compute.

3) Compliance as a Feature

Build real time KYC and AML checks, automated data lineage, policy as code, and continuous monitoring directly into journeys. When a model makes a prediction, the system should log the inputs, the version, and the decision record. If a process breaks a rule, the orchestration layer should raise an alert or roll back automatically. Banks that treat compliance as part of the product move faster because approvals are built into the flow rather than bolted on at the end.

To achieve lasting impact in 2026, financial institutions must focus on scaling AI models within well-defined guardrails, embrace cloud-smart modernization that balances product innovation with cost efficiency, and embed compliance seamlessly into product workflows. These core themes form the foundation for transforming isolated AI experiments into enterprise-wide capabilities that drive measurable business value.

With these principles in place, organizations are better positioned to accelerate AI adoption while maintaining control, setting the stage for practical, high-impact AI use cases that deliver visible ROI across the financial ecosystem.

High-Impact Use Cases for Visible ROI from AI in Financial Services

In the rapidly evolving financial services industry, demonstrating tangible returns on investments into artificial intelligence is crucial.

Below, we look at high-impact use cases that not only showcase measurable business value but also pave the way for scalable AI adoption across financial institutions.

By focusing on practical applications, from contact center AI to real-time fraud detection, organizations can accelerate their AI journey, optimize operational efficiency, and enhance customer interactions with confidence and control.

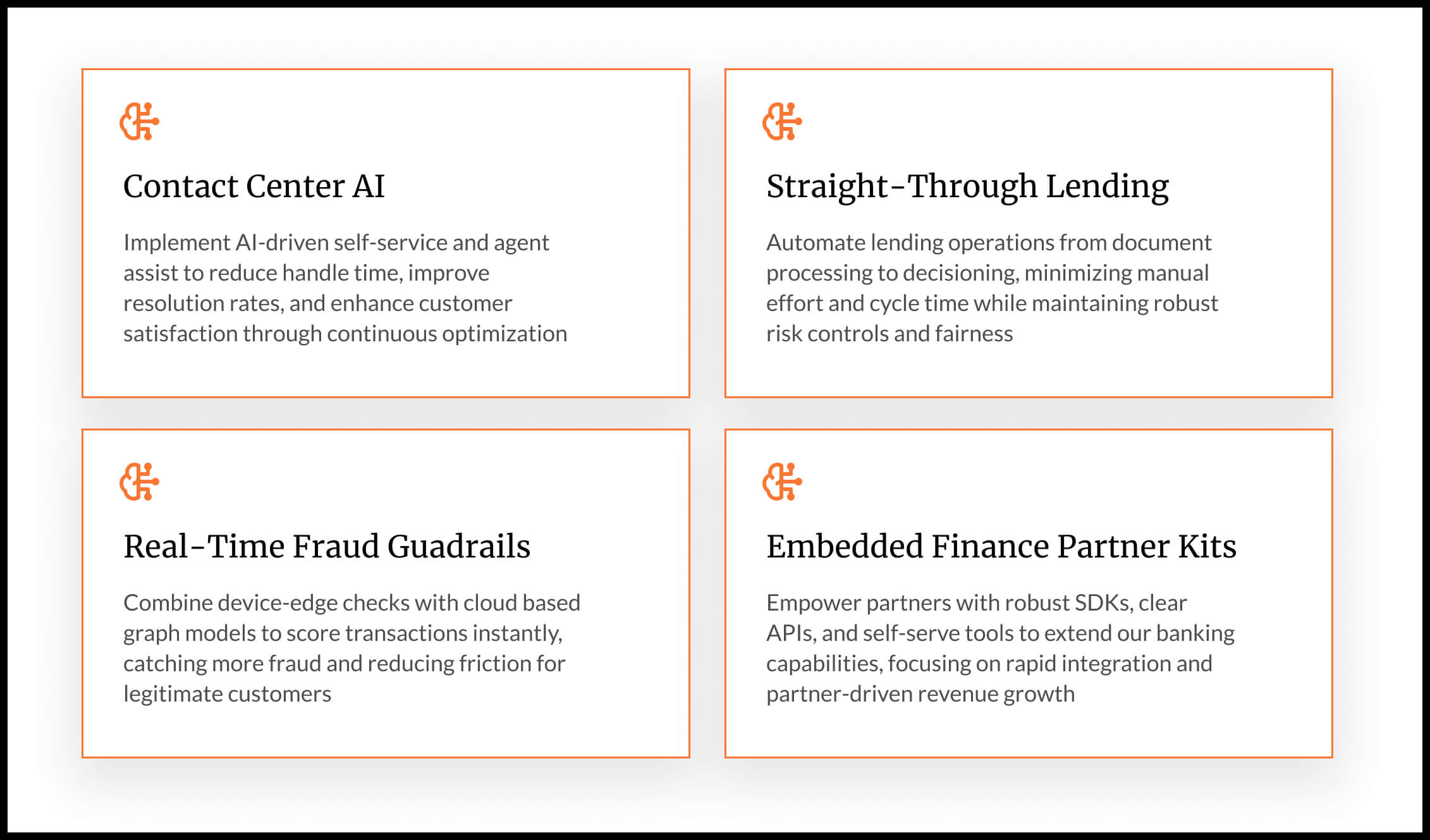

Contact Centre AI

Contact center AI is the quickest path to visible impact.

- Start with authenticated self service for common intents like balance, password reset, card replacement, and charge dispute.

- Use the agent to gather context, check entitlements, and draft the action.

- Use automation to execute in core systems, and set a simple rule that high risk steps require human approval.

- Measure average handle time, first contact resolution, containment rate, and customer satisfaction.

- Build a playbook for continuous improvement that tunes prompts, updates knowledge, and expands coverage each week.

The target is a steady rise in resolution without transfers and a decline in repeat calls.

Straight-Through Lending

Straight through lending operations reduce cycle time and manual effort while protecting risk.

- Begin with intelligent document processing to extract identity, income, and collateral data.

- Add a policy agent that checks credit rules, thresholds, and exceptions.

- Route only ambiguous or high-risk applications to underwriters.

- Keep a hard rule that any decline requires human review until the model shows stable precision.

- Instrument time to decision, pull through rate, and manual touch points per file.

- Use a feature store to avoid repeated data wrangling across products.

Over quarters, expand the same capability to small business lending and embedded credit at partners, while keeping clear guardrails for fairness and explainability.

Real-Time Fraud Guardrails

Real-time fraud guardrails combine fast edge checks with deeper cloud models.

- At the device or channel edge, run lightweight checks on behavior, device reputation, and basic velocity.

- In the cloud, maintain richer graph models and sequence models that spot patterns across accounts and merchants.

- Use streaming to score transactions as they happen and set confidence bands that decide whether to allow, step up, or block.

- Track fraud loss rate and false positive rate side by side and publish them to product and risk weekly.

The goal is to catch more bad events while reducing friction for good customers. Practice rollback by simulating model drift and switching to a prior version without customer impact.

Embedded Finance Partner Kits

Embedded finance partner kits turn bank capabilities into channels.

- Package a partner ready SDK with clear APIs, consent and privacy modules, reference flows, and sandbox data.

- Offer a self-serve portal with pricing meters and integration health.

- Publish time to first transaction as a visible promise.

- Internally, route partner traffic through the same compliance and monitoring controls as your primary channels.

- Measure partner activation rate, time from contract to first transaction, revenue per active partner, and incident rate.

Over time, create differentiated tiers for partners, with premium SLAs and co-marketing for those who meet quality and volume thresholds.

These high-impact AI use cases demonstrate how financial institutions can deliver measurable ROI by focusing on practical, scalable applications that enhance operational efficiency, risk management, and customer experience.

By implementing such solutions, organizations can build a strong foundation for broader AI adoption while maintaining necessary AI governance and control.

With these building blocks in place, the next critical step involves establishing disciplined execution practices to ensure AI initiatives transition from isolated pilots to sustainable, product-led transformations.

Execution Discipline: How to Work Like a Product Organization

How you work will determine how much impact you can ship. In the fast-paced and highly regulated world of financial services, the way teams organize, collaborate, and execute AI initiatives directly influences the success and scalability of those projects.

Effective workflows, clear accountability, and cross-functional collaboration are essential to move beyond isolated pilots and deliver measurable business value.

The following are the key organizational practices and governance frameworks that empower financial institutions to transition from experimentation to product-led AI deployment, ensuring that AI investments translate into real, sustainable impact across the financial ecosystem.

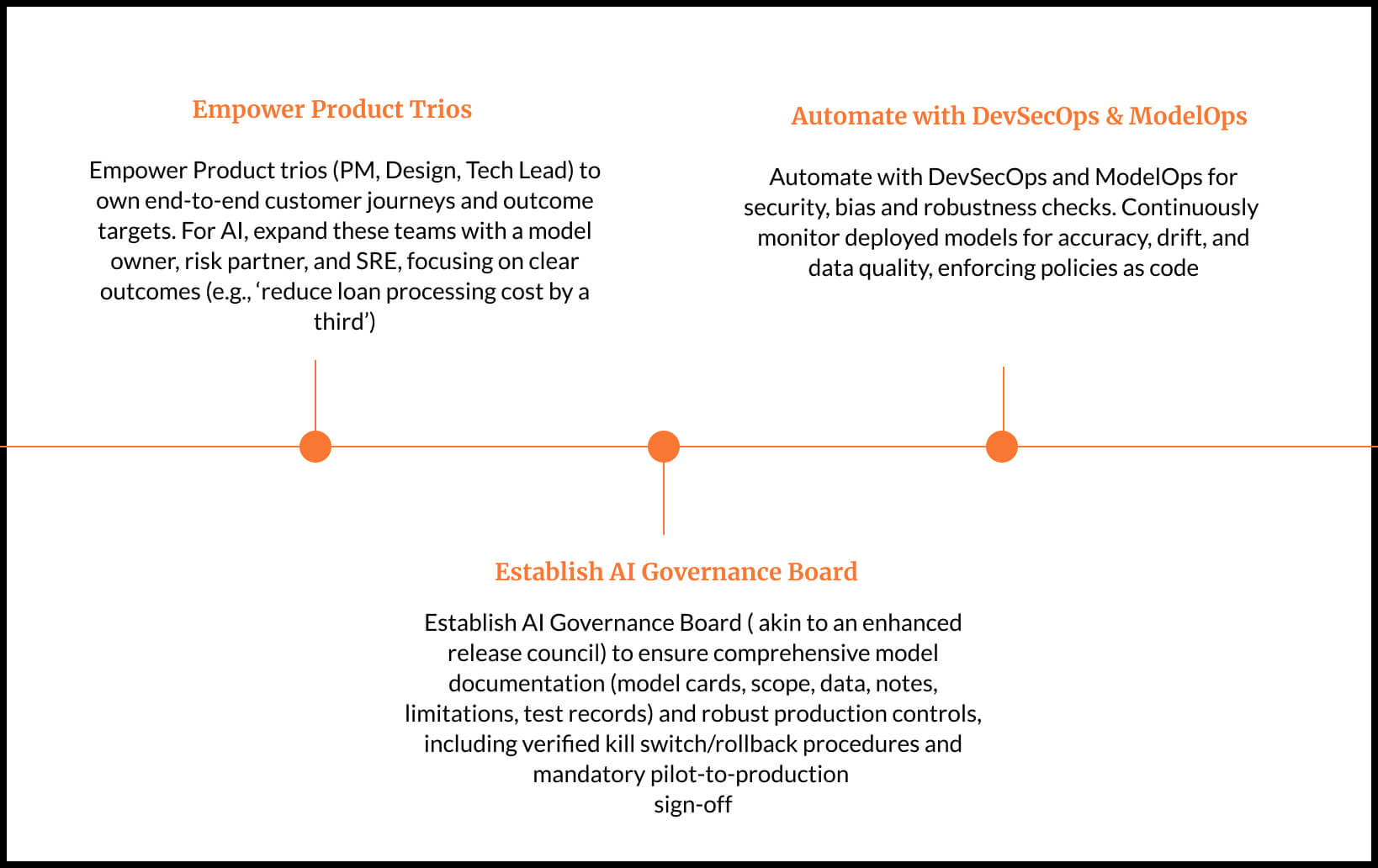

Empower Product Trios

Organize around product trios that own a journey end to end. A trio includes a product manager, a design lead, and a tech lead who share the same outcome targets. For any AI-heavy journey, extend the trio to include a model owner, a risk or compliance partner, and an SRE or operations lead. Write down the outcome in plain language. For example, raise authenticated self-service to half of all servicing contacts, or reduce loan processing cost by a third within nine months.

Establish AI Governance Board

Stand up an AI governance board that functions like an enhanced release council. Every model and agent should have a model card, clear scope, training data notes, known limitations, and a test record. Define kill switch and rollback procedures and verify them in drills. Require sign off to move from pilot to production and again to move from controlled scale to broad scale. Keep the paperwork light but the evidence strong. The board exists to create confidence so that teams can move faster, not to slow them down.

Automate with DevSecOps and ModelOps

Adopt DevSecOps and ModelOps as your default pipeline. Automate security scans, dependency checks, data policy checks, and bias and robustness checks. Instrument every deployed model for accuracy, drift, and data quality, and send the metrics to a shared dashboard. Treat policies as code. If personal data cannot be used for training, enforce that in the pipeline with automated filters and audits rather than manual review.

Metrics That Matter: Measuring Product-Led AI ROI

| Metric | What it shows |

| Cost to Serve per Transaction | Average fully loaded cost to complete one customer transaction or request |

| First Contact Resolution Rate | Percentage of issues resolved without follow-up within 7 days |

| AI Containment Rate | Percentage of inquiries resolved entirely by AI without human escalation |

| Time to Decision (Lending) | Median hours from complete loan application to approval/decline |

| Manual Touch Points per File | Average number of human steps required per loan or application |

| Fraud Loss Rate | Fraud losses expressed as basis points of total transaction volume |

| False Positive Rate (Fraud) | Percentage of legitimate transactions wrongly flagged as fraud |

| Release Frequency | Number of software deployments per service per month |

| Defect Escape Rate | Bugs found in production per 1,000 test cases |

| Compliance Findings | Number of open audit or regulatory issues tied to a product journey |

| Time to Approval (Compliance) | Median days to approve a new AI model, feature, or policy change |

Anchor AI outcomes in hard, comparable metrics.

Pick a small, hard set of measures for each journey and put them on a weekly review. Cost to serve per customer or per transaction shows efficiency. Average handle time shows servicing productivity. Release frequency and defect escape rate show engineering health. Fraud loss rate and false positives show risk performance. Compliance findings and time to approval show control health.

Baseline them before you change the journey. Link every feature release to the movement in these measures so you can attribute impact.

When you calculate ROI, use scenarios and include multiple value drivers. A call center agent may save labor, protect revenue by reducing churn through faster resolution, and lower risk by reducing errors. A lending system may reduce manual cost, lower loss provisions through better risk signals, and grow volume by shrinking time to yes. Present optimistic, base, and pessimistic ranges with clear assumptions, and set a payback period target for each phase. This gives finance a clear view of value and lets you adjust investment with discipline.

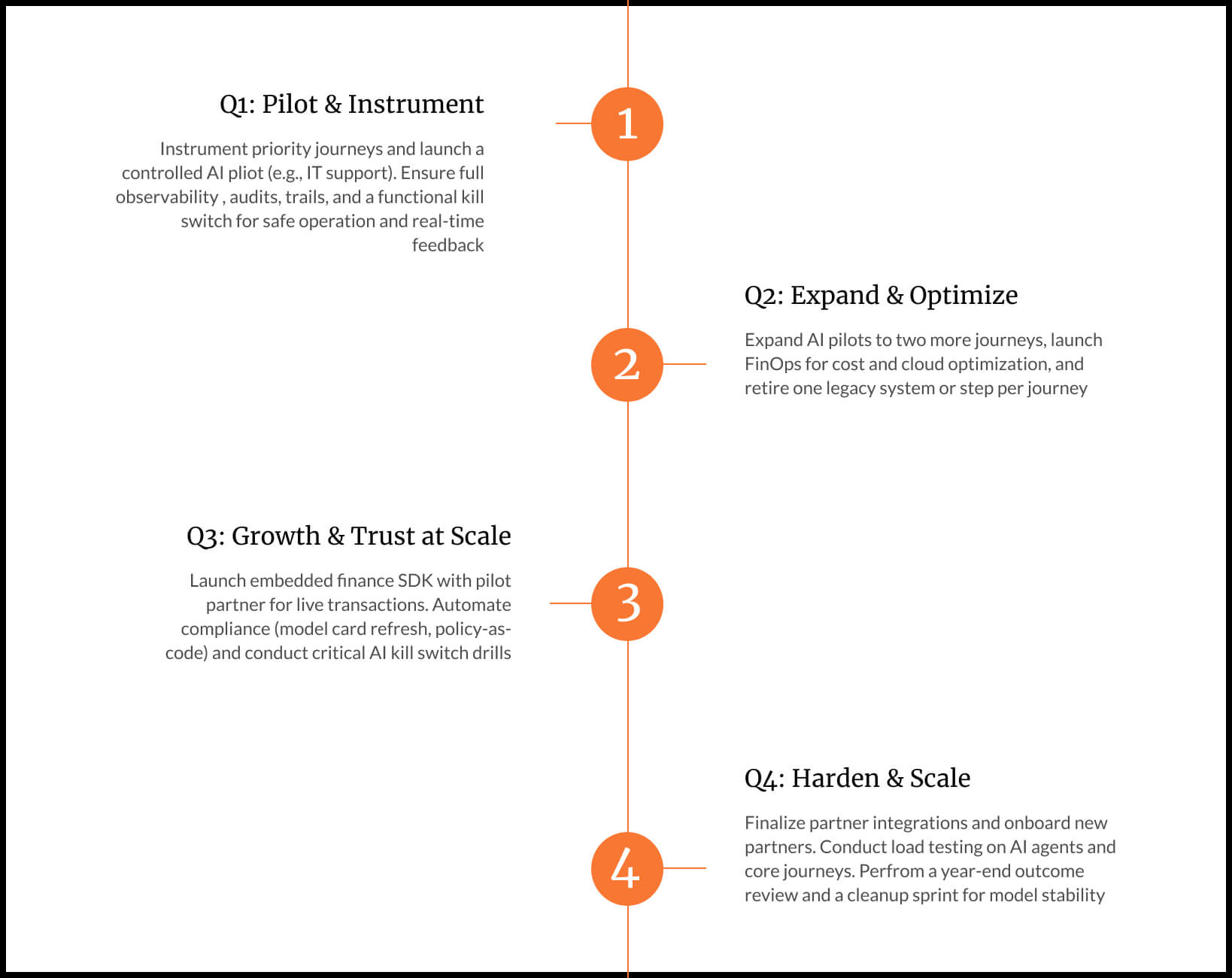

Quarter-by-Quarter 2026 Roadmap for the Financial Sector

A successful AI strategy in financial services doesn’t unfold overnight—it’s built quarter by quarter, through disciplined execution, measurement, and iteration.

The following roadmap lays out a structured 2026 action plan for banks and financial institutions ready to move beyond pilots and into measurable, governed impact.

Each phase emphasizes controlled scaling, financial visibility, and operational trust—ensuring that every new AI capability strengthens both performance and compliance.

From early pilots in Q1 to enterprise-wide rollout by Q4, this roadmap translates strategic ambition into a practical delivery sequence Product leaders can execute against, proving that AI progress and accountability can evolve together.

Q1: Pilot & Instrument

In the first quarter, instrument the priority journeys and launch one controlled AI pilot. Choose a domain with clear benefit and contained risk, such as internal IT support or a small segment of retail servicing. Deploy with observability, audit trails, and a kill switch from day one. Confirm that you can see inputs, outputs, and user feedback in real time and that you can stop or revert without disruption.

Q2: Expand & Optimize

In the second quarter, expand to two more journeys and bring a FinOps dashboard to life that shows unit cost per journey and per feature. Use the data to right environments, tune commitments, and remove waste. Retire one legacy step or system per journey so that savings are real and complexity drops. Publish a quarterly note to leadership that ties outcomes to shipped capabilities and to cost trends.

Q3: Growth & Trust at Scale

In the third quarter, shift to growth and trust at scale. Release the embedded finance SDK and sign at least one partner pilot that processes live transactions. Automate compliance workflows so that model updates trigger model card refresh, sign off, and notifications. Shorten time to compliance for new features through policy as code and automated evidence capture. Practice kill switch drills on critical agents and record the results.

Q4: Harden & Scale

In the fourth quarter, harden and scale. Push partner integrations into production and onboard more partners based on the pilot lessons. Load test AI agents and core journeys against peak scenarios. Conduct a year-end outcome review that compares actuals to targets for each journey. Run a cleanup sprint to fix gaps, retrain drifting models, and document runbooks so the improvements become the new normal.

By the end of 2026, leading financial institutions won’t be the ones that experimented the most with AI but the ones that delivered results that could be tracked, audited, and repeated.

This roadmap provides a proven rhythm to reach that state: pilot carefully, expand deliberately, scale responsibly, and harden continuously. Following this cadence allows banks to modernize with confidence: embedding FinOps, compliance, and performance tracking into every journey. The outcome is more than operational efficiency; it’s a measurable, sustainable transformation where AI drives tangible gains in cost, speed, and trust.

But as AI adoption accelerates, so do the risks that come with it. That’s why every step of this roadmap must be paired with a proactive risk playbook that anticipates, measures, and mitigates challenges before they scale.

The next section explores those risks in depth and outlines how to build resilience into every AI product and process from day one.

The Operational AI Risks to Watch in 2026

AI maturity brings new operational risks:

- Model drift is inevitable as behavior and fraud patterns change. Mitigate it with staged rollouts, shadow mode comparisons, confidence thresholds, and scheduled retraining. Keep humans in the loop for high-risk decisions until the model shows sustained stability.

- Unclear ROI and scope creep are common failure modes. Prevent them by mapping outcomes before build, funding in small tranches tied to metric movement, and running monthly stop or scale reviews. Celebrate the act of stopping work that does not move the needle.

- Cloud cost creep can erase benefits if left unchecked. Treat cost as a feature. Use FinOps to rightsise resources, increase commitment coverage, and include SaaS and AI compute in the same view. Track unit costs per user and per transaction and set alerts that flag anomalies in hours, not weeks.

- Compliance gaps create regulatory and reputation risk. Build explainability into every decision. Log inputs, outputs, and reasons that a decision was made. Encode policy into orchestration so a violation triggers a halt or rollback. Stay current with evolving AI guidance and rehearse audits by producing evidence on demand.

- Fraud and safety incidents can arise from adversarial inputs or misuse of automation. Layer defenses. Combine edge checks, central models, rules, and human oversight. Red team your agents and models to probe for prompt injection and jail breaks. Limit who can retrain a model or approve an automated action and monitor those actions closely.

Treat these not as blockers, but as design constraints for resilient product delivery.

Three Key Financial Services Journeys Set for AI-Driven Transformation by December 2026

By year end, three priority journeys should show material gains:

- In retail servicing, average handle time falls and authenticated self service rises.

- In lending, manual touches drop and time to decision shrinks from days to hours.

- In fraud, losses fall while false positives drop, which means fewer good customers are blocked.

You will have a governed agent platform, not a pile of disconnected pilots. There is a registry of models and agents with owners, scope, risk ratings, performance metrics, and model cards. Significant changes follow a simple approval path. Kill switches are verified and documented.

Your technology stack will be cloud smart and proven in the numbers. Release frequency increases, defect escape rate declines, and unit costs per journey are visible and trending in the right direction. The platform blends cloud services and on premises where it makes sense and uses infrastructure as code for repeatability.

Compliance becomes continuous and code based. Data lineage is available on demand. Automated decisions can be explained to customers and auditors. If a model needs to be rolled back, operations can do it without drama and without customer impact.

Final Takeaways: Successful AI Integration in Financial Services

The winners in 2026 will not be the banks with the longest list of AI pilots; they will be the banks that can point to a few journeys that are now thirty percent better, and can show the math.

The formula for impact is clear:

- Focus AI investment on fewer, measurable journeys that link directly to P&L metrics.

- Treat governance and explainability as accelerators, not blockers.

- Build FinOps visibility into every product journey to prevent cost creep.

- Shift from pilot culture to product culture and own outcomes end-to-end.

- Use compliance and policy-as-code to unlock speed, safety, and trust.

- Scale only when the numbers prove it.

Move with bold intent and with control. The hype cycle has ended. The impact cycle has begun.

FAQs

What makes AI adoption in financial services different from other industries?

AI in financial services operates under heightened regulatory scrutiny. Every model must be explainable, auditable, and reversible — making governance a prerequisite for innovation.

How can Product teams prove ROI on AI initiatives?

Link each feature to quantifiable business metrics like cost to serve, time to decision, and fraud loss rate. Establish baselines, measure deltas, and communicate results quarterly.

What’s the most common pitfall in scaling AI for banks?

Automating broken processes. Always stabilize and instrument a journey before introducing AI — otherwise, you scale inefficiency, not value.

How does FinOps support AI scalability?

By making cloud and compute costs visible per feature and per transaction, FinOps enables teams to optimize usage, prevent waste, and tie cost directly to value delivered.