Jump To Section

- 1 Understanding the Fintech Threat to Banking Solutions

- 2 Barriers to Banking Innovation: What’s Holding Traditional Institutions Back

- 3 Strategies to Accelerate Product Innovation in Traditional Banks

- 4 Building an Innovation Culture in Banking: How to Shift Mindsets and Metrics

- 5 Strategic Partnerships and Collaboration in Core Banking Solutions

- 6 Banking Innovation Case Studies: JPMorgan Chase, DBS, and BBVA in Action

- 7 Key Takeaways: Next Steps for Thriving in the Age of Fintech Disruption

- 8 FAQs

By 2026, fintechs are projected to capture nearly 25% of global banking revenues, according to a 2025 McKinsey report.

Fintech startups and embedded finance providers are redefining the rules of engagement by leveraging technology, focusing on customer-centricity, and speed to deliver innovative financial products. Traditional banks, once the undisputed leaders in the sector, now face mounting pressure to evolve rapidly or risk losing relevance.

The rise of neobanks, Buy Now Pay Later (BNPL) platforms, crypto-based financial services, and big tech’s disruption into finance has created an environment where customer expectations are higher than ever. To remain competitive, traditional banks must prioritize faster product innovation and adopt capabilities that allow them to compete with the agility and creativity of fintech disruptors.

This article explores the nature of the fintech threat, the barriers banks face in innovating, and actionable strategies for overcoming these challenges while adopting a modern core banking solution.

Understanding the Fintech Threat to Banking Solutions

Fintech companies are no longer just fringe innovators, they’ve become formidable players in the financial ecosystem, particularly in North America.

From payments to personal finance, these agile competitors are reshaping customer expectations and redefining the standard for digital banking experiences. In fact, fintech companies accounted for nearly 40% of new financial services revenue growth globally in 2024, according to Accenture.

For traditional banks, understanding the scope and scale of this disruption is step one in developing a viable strategy for survival and growth. The threat is not abstract; it’s unfolding now, and it’s happening across every core banking function.

Market Disruption Overview

Fintech companies have fundamentally transformed customer expectations in financial services. Consumers now demand:

- Speed: Instant account opening, real-time payments, and immediate loan approvals.

- Simplicity: Intuitive interfaces and frictionless user experiences.

- Personalization: Tailored financial products based on individual needs and behaviors.

Fintechs have set new benchmarks by leveraging AI capabilities to deliver these attributes at scale. This shift has left traditional banks struggling to keep pace with customer demands and client expectations.

Emerging Competitors Amongst Core Banking Solutions

The competitive landscape is no longer limited to traditional banks. Fintech disruptors have emerged across various niches:

- Neobanks and Digital-first Banks

Examples: Revolut, Chime, N26

Neobanks operate without physical branches, offering low-cost digital banking services with features like fee-free accounts, budgeting tools, and real-time notifications. Their lean operating models allow them to innovate rapidly.

- Buy Now Pay Later (BNPL) Platforms

Examples: Klarna, Afterpay

BNPL providers have disrupted traditional credit models by offering interest-free installment payments at the point of sale. Their seamless integration with e-commerce platforms has made them a preferred choice for younger consumers.

- Embedded Finance Providers

Examples: Shopify, Amazon

Embedded finance integrates financial services directly into non-financial platforms. For instance, Shopify offers payment processing and lending to its merchants, bypassing traditional banks entirely.

- Crypto-based Financial Services

Examples: Coinbase, Robinhood Crypto

Cryptocurrency exchanges and wallets are redefining how people store value, invest, and transact globally. Decentralized finance (DeFi) platforms further challenge banks by offering alternatives to loans, savings accounts, and investments.

- Big Tech Financial Initiatives

Examples: Apple Financial Services, Google Pay

Tech giants are leveraging their massive user bases and advanced technology infrastructure to offer payment solutions, credit cards, and even deposit accounts.

- Super Apps and Digital Wallets

Examples: WeChat Pay, Alipay, PayPal

Super apps combine multiple services like payments, shopping, investments, into a single platform. Their convenience and ecosystem approach make them highly attractive to customers.

These competitors are agile and unburdened by legacy systems or regulatory baggage. They focus on niche markets but are rapidly expanding their reach into core banking functions.

All of these fintech companies have one thing in common: speed. Whether it’s launching new products, integrating feedback, or scaling operations, they move faster and more nimbly than traditional banks.

The good news? Banks still hold the advantage in trust, infrastructure, and regulatory experience. The challenge now is to combine those strengths with the adaptability of a startup. That begins by acknowledging the real threat fintechs pose – not to market share alone, but to customer expectations and responding with urgency and intent.

Barriers to Banking Innovation: What’s Holding Traditional Institutions Back

Despite having scale, trust, and decades of market presence, traditional banks are finding themselves on the back foot in the innovation race.

According to a 2024 report by PwC, nearly 75% of banking executives cite “inability to innovate quickly” as one of their top three threats to growth. While many recognize the need for digital transformation, deeply embedded legacy systems and organizational resistance continue to slow down progress.

Meanwhile, fintechs are rapidly iterating, launching new features, and meeting customer demands in real time.

The gap isn’t just technical, it’s cultural, structural, and strategic. To respond effectively, banks need to examine the full spectrum of barriers holding them back and develop targeted strategies to overcome them.

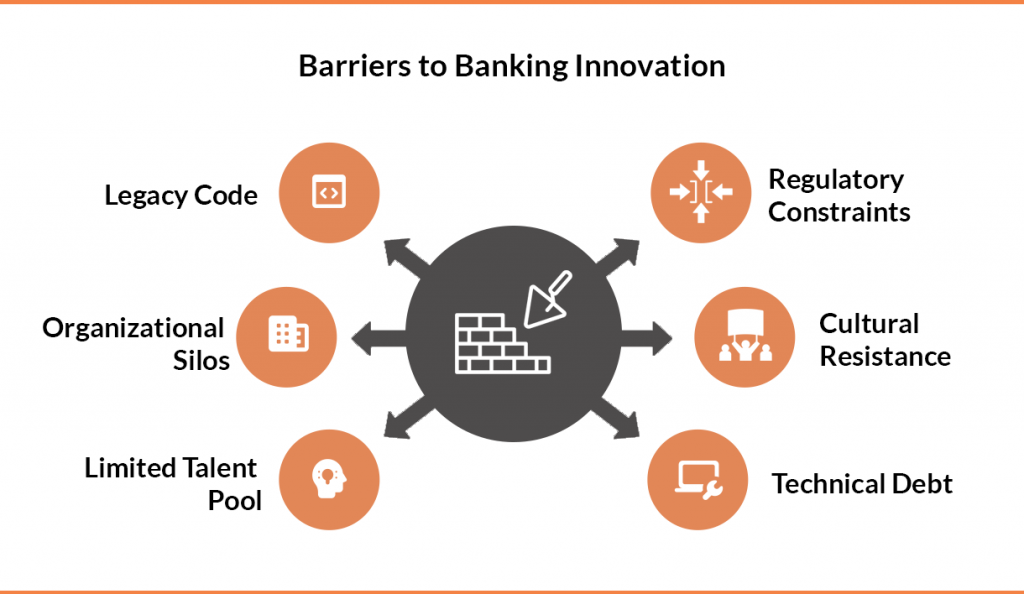

Understanding these roadblocks is a critical first step in building innovation muscle and staying relevant in a fast-evolving industry. While fintechs thrive on agility and new products, traditional banks face significant hurdles that slow down their ability to compete:

1. Legacy Code, Systems and Infrastructure

Most banks operate on outdated core banking software that were designed decades ago. These systems are expensive to maintain and difficult to integrate with modern technologies like APIs or cloud computing. The cost of overhauling these systems often deters innovation initiatives.

2. Regulatory Constraints

Banks operate in a heavily regulated environment that prioritizes stability over experimentation. Compliance requirements for daily banking transactions can slow down product development cycles as every new feature must go through rigorous scrutiny.

3. Organizational Silos

Traditional banks often suffer from siloed departments that hinder collaboration between teams like IT, marketing, compliance, and product development. These silos create bottlenecks in achieving operational efficiency and better decision-making processes.

4. Cultural Resistance to Change

Risk aversion is deeply ingrained in banking culture due to the critical nature of financial systems. This mindset discourages experimentation and makes it difficult for innovative ideas to gain traction within the organization.

5. Limited Digital Talent Pool

Banks often struggle to attract top tech talent who prefer working for dynamic fintech startups or big tech companies offering more innovative environments. To hire and retain top talent, there are several career progressions and strategies that can offer motivation to potential Fintech employees, like the ones highlighted in this article here.

6. Technical Debt

Maintaining outdated codebases diverts resources away from new initiatives. Technical debt also limits flexibility when trying to replace legacy code and implement modern technologies or respond quickly to market changes.

For a deep-dive, practical guide and insights on overcoming AI adoption challenges in Banking, watch this expert webinar.

Strategies to Accelerate Product Innovation in Traditional Banks

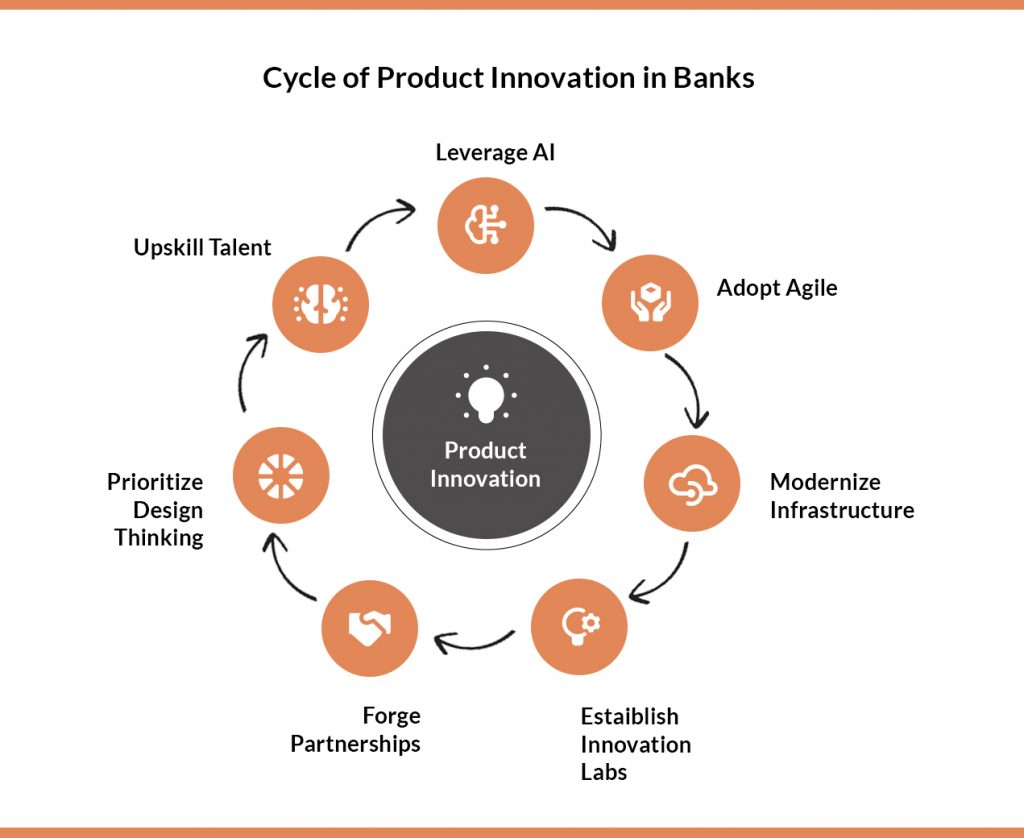

To overcome these barriers and compete effectively with fintech disruptors, traditional banks must adopt a multi-pronged approach:

Leverage AI, Automation, and Predictive Analytics

- Predictive Analytics: Use data-driven insights to anticipate customer needs and market trends.

- Automated Compliance: Streamline regulatory processes using AI-powered tools.

- Personalization: Leverage machine learning algorithms and AI capabilities to extract customer data and deliver tailored recommendations and offers in real time.

Adopt Agile Development and MVP Frameworks

- Develop minimum viable products (MVPs) quickly to test ideas for new products in the market.

- Form cross-functional teams (agile squads) that include members from IT, product design, compliance, and marketing.

- Use iterative feedback loops to continuously improve products based on user input.

Modernize Infrastructure with Cloud and APIs

- Migrate legacy systems to cloud-based infrastructure for greater scalability and flexibility. Learn more about Mastering Cloud Transformation from a Cloud Services Leader here.

- Leverage APIs through open banking frameworks to integrate third-party fintech solutions seamlessly.

Establish Innovation Labs and Incubators

- Create dedicated spaces where teams can experiment with new ideas without fear of failure.

- Partner with startups through accelerators or incubators to co-develop innovative solutions.

Forge Strategic Fintech Partnerships or Acquisitions

- Collaborate with fintechs instead of competing directly by forming mutually beneficial partnerships.

- Acquire promising startups to bring their technology in-house while retaining their innovative culture.

Prioritize Customer-Centric Design Thinking

- Implement design-thinking methodologies that prioritize solving real customer pain points.

- Involve customers early in the development process through surveys or beta testing programs.

Upskill and Attract Digital-First Talent

- Invest in training programs for existing employees to build digital skills.

- Offer competitive packages or flexible work environments to attract top talent from tech industries.

Building an Innovation Culture in Banking: How to Shift Mindsets and Metrics

Innovation is not just about technology, it’s also about mindset:

- Encourage experimentation by creating safe spaces where employees can test new ideas without fear of failure.

- Reward employees who contribute innovative solutions through recognition programs or incentives.

- Foster a culture that balances risk-taking with compliance by aligning innovation efforts with regulatory frameworks.

- Set clear innovation KPIs (e.g., time-to-market for new products) that hold leadership accountable for fostering progress.

Strategic Partnerships and Collaboration in Core Banking Solutions

Banks and financial institutions don’t need to innovate alone, they can leverage external ecosystems to enhance their core banking solutions and systems.

By engaging with a diverse range of partners, banks can access a wealth of expertise and resources that can drive innovation and improve operational efficiency.

- Collaborate with fintech startups through joint ventures or co-development projects. This collaboration allows banks to tap into the innovative spirit and agile methodologies of fintech companies, leading to the development of new financial products and services that meet evolving customer needs. By working together, banks can accelerate their digital transformation journey and enhance their core banking systems. This partnership can also help banks explore new business models and operating models, ensuring they remain competitive in the fast-paced banking industry.

- Partner with technology providers specializing in AI capabilities, blockchain, or cloud computing. Such partnerships enable banks to integrate cutting-edge technologies into their core banking platforms, improving operational efficiency and customer experience. For instance, AI can be used to personalize banking services, blockchain can enhance security and transparency, and cloud computing can provide scalability and flexibility to core banking systems. These technologies facilitate seamless daily banking transactions and improve account management, enabling banks to offer superior banking services.

- Work with academic institutions on research initiatives focused on emerging technologies like quantum computing or advanced cryptography. Collaborating with academia can provide banks with access to groundbreaking research and innovations that can be applied to enhance their core banking solutions. These partnerships can lead to the development of new operating models and business strategies that keep banks competitive in the rapidly evolving financial landscape.

By forming strategic partnerships and collaborations, banks can leverage external expertise and resources to drive innovation, improve their core banking systems, and offer superior banking services to their customers. This collaborative approach allows banks to stay ahead of the curve and meet the demands of the modern banking industry.

In doing so, banks can enhance their market share, support digital transformation, and ensure compliance with regulatory requirements, all while delivering exceptional customer service and experiences.

Banking Innovation Case Studies: JPMorgan Chase, DBS, and BBVA in Action

Several financial institutions have successfully embraced innovation:

PMorgan Chase

Digital Wallets and AI Fraud Detection: The bank invested heavily in AI-driven fraud detection systems while launching its own digital wallet platform (Chase Pay). It also formed partnerships with fintechs like OnDeck for small business lending.

DBS Bank (Singapore)

Cloud Migration and Innovation Labs: DBS transitioned into a “digital-first” bank by adopting cloud computing infrastructure and launching its own innovation lab (“DBS Asia Hub”). It has won multiple awards for its mobile banking app’s seamless user experience.

BBVA (Spain)

Open Banking Strategy and Third-party Integrations: BBVA implemented an open banking strategy as its core banking system by launching APIs that allow third-party developers to integrate directly with its platform, creating new revenue streams while enhancing customer experience.

Key Takeaways: Next Steps for Thriving in the Age of Fintech Disruption

To compete in a landscape defined by constant disruption, traditional banks must make innovation a core operating principle, not just a project. The following actions will lay the foundation for sustained transformation:

- Identify and Remove Internal Barriers

Start with an innovation audit to pinpoint friction points like legacy systems, siloed departments, and risk-averse culture, and address them with clear leadership alignment and change management.

- Pilot Agile, Cross-Functional Teams

Empower small, focused teams to rapidly build and test new product ideas using agile methodologies and customer feedback loops.

- Modernize Infrastructure with Cloud, APIs, and AI

Shift away from monolithic systems toward composable architectures. Integrate AI, automation, and cloud-native tools to improve speed, compliance, and personalization.

- Leverage Strategic Fintech Collaborations

Partner with fintechs or acquire niche capabilities to accelerate innovation and access new markets without scaling internal complexity.

- Embed Innovation into Culture and KPIs

Move beyond one-off digital initiatives. Build a culture where innovation is measured, incentivized, and embedded across departments—from compliance to customer service.

Future Outlook: What’s Coming—and Why Banks Must Prepare Now

The next wave of disruption won’t just come from fintech startups—it will come from emerging technologies and new customer paradigms. Banks must begin preparing for:

- Generative AI: Tools like ChatGPT and Claude are already transforming how products are built, tested, and supported. In banking, GenAI will accelerate product design, compliance automation, and hyper-personalized customer experiences.

- Decentralized Finance (DeFi): While still emerging, DeFi infrastructure is pushing the boundaries of trustless transactions, digital identity, and programmable money. Traditional banks that ignore this shift risk losing tech-native customers to decentralized ecosystems.

- Quantum Computing: With security implications across encryption and financial modelling, quantum readiness will soon become a board-level concern for institutions.

- Embedded Finance: The rise of platform banking means financial products will increasingly be distributed through non-bank channels, requiring banks to think beyond their owned customer interfaces.

- Sustainability and ESG-linked Products: Regulatory and consumer pressure are converging on banks to offer greener, more transparent products, a key area for innovation tied to long-term differentiation.

Banks that adopt a future-back strategy, anticipating these shifts and investing now – will be the ones that lead the next phase of financial services transformation. Innovation isn’t just a competitive advantage any more, it’s the cost of entry into tomorrow’s banking ecosystem.

FAQs

How can banks transition to agile without overhauling their entire infrastructure?

Start with small, cross-functional teams (agile squads) focused on specific products or services. This allows banks to pilot agile methodologies without disrupting existing systems.

What are the biggest risks in partnering with fintechs?

Potential risks include data security concerns and cultural mismatches. Mitigate these with robust due diligence and clear contractual agreements.

How does open banking benefit traditional banks?

Open banking enables banks to integrate innovative third-party solutions, enhancing customer experience and creating new revenue streams while staying compliant with regulations.