Jump To Section

- 1 Where AI Investments Will Matter Strategically

- 2 Architectural Foundations: Building the Trustworthy Core

- 3 Streaming Pipelines: Powering Real-Time Readiness

- 4 Analytics Evolution: From Dashboards to Decisions

- 5 RegTech as a First-Class Workload

- 6 AI Adoption Use Cases: Where Financial Institutions Can Start Today

- 7 Structuring for Scalable AI: Operating Model & Roles

- 8 Implementation Roadmap: A Year of Real Progress

- 9 Measuring AI Adoption Impact Through KPIs and Real Value

- 10 Final Takeaways: 5 Principles Guiding the 2026 Mindset

- 11 FAQs

Your 2025 AI experiments were necessary. But if they didn’t move the needle on your balance sheet, you’re not alone. In 2026, that’s no longer an excuse. The era of accountable AI is here, and your leadership is on the hook.

Financial institutions poured energy into experimenting with generative and agentic AI, yet implementation remained sporadic, limited to proofs of concept and innovation labs.

In 2026, the focus pivots sharply from what AI can do to how it can be industrialized responsibly. This year marks a maturity shift from exploration to execution, where the challenge isn’t building new models but integrating them safely into governed data ecosystems that can withstand regulatory and audit scrutiny.

The market sentiment reflects this evolution. According to Gartner’s 2025 AI Maturity Curve, only 11 percent of financial firms report measurable ROI from AI initiatives, while the rest remain stuck in pilot purgatory.

At the same time, the World Economic Forum’s 2025 Financial Services Outlook highlights a mounting pressure on executives to demonstrate accountable AI value; in other words, to link models and analytics directly to business outcomes.

The new standard for 2026 is “AI accountability”, a phase defined not by novelty, but by traceability, explainability, and performance tied to compliance and cost.

This article outlines key trends that form a practical 2026 roadmap for financial services (FS) institutions: how to modernize data foundations, operationalize analytics, embed regulatory intelligence, and measure adoption impact. It is not another hype cycle; it’s a blueprint for implementation in 2026 that regulators can trust and executives can measure.

Where AI Investments Will Matter Strategically

2026 will reward financial institutions that invest not in more models, but in smarter foundations. The year ahead will separate firms that chase AI capabilities from those that engineer the infrastructure, governance, and literacy required to scale them safely.

Gartner’s Top Data and Analytics Trends for 2025 predicts that by 2026, 60 percent of successful AI initiatives will depend on modernized data platforms capable of lineage, observability, and interoperability. In other words, data readiness equals AI readiness.

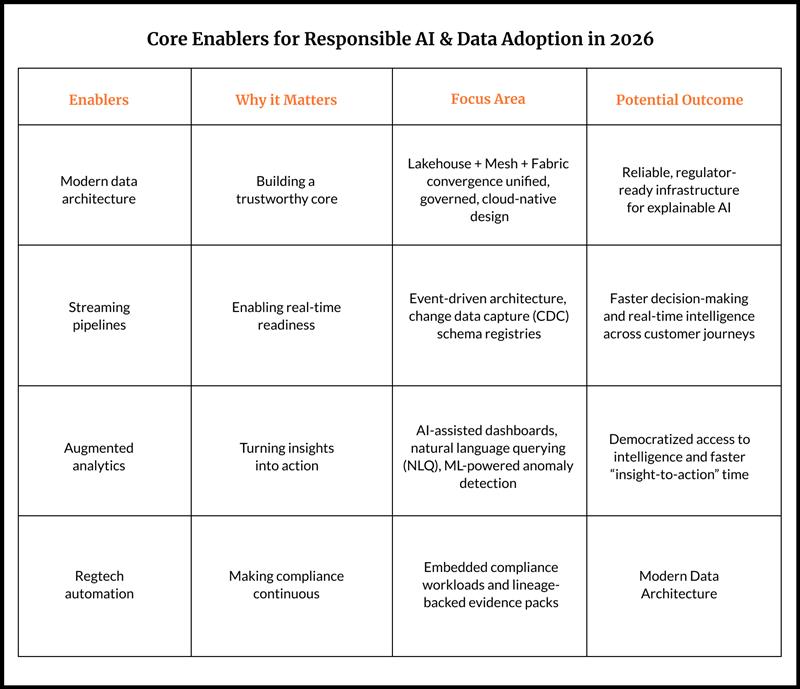

Successful adoption will hinge on four foundational enablers:

1. Modern Data Architecture

Unified, governed, and cloud-native to support structured and unstructured data across domains.

2. Streaming Pipelines

Enabling real-time readiness and event-driven decisioning across customer and risk journeys.

3. Augmented Analytics

Democratized insights powered by natural language and machine learning for every business user.

4. RegTech Automation

Embedding compliance and explainability as first-class workloads within AI pipelines.

The 2026 roadmap for higher AI and data adoption in financial services, driven by these four trends, looks like this:

More than just hyped up buzzwords, these enablers set the conditions under which AI can be trusted, scaled, and regulated.

The following sections unpack each of them in detail, with specific 2026 priorities, real-world use cases, and measurable business outcomes.

Architectural Foundations: Building the Trustworthy Core

In 2026, your data architecture isn’t just a technical spec; it’s your compliance posture and your market differentiator. You can either build a trustworthy core, or you can build a house of cards. Regulators will know the difference. The winners in 2026 will be those that treat data architecture as both a performance and compliance asset, a foundation that powers agility, trust, and regulator-ready transparency.

Unifying the Data Landscape

Most banks and insurers still operate with fragmented warehouses, duplicated systems, and siloed ownership, an architecture that stalls any real AI momentum. The new north star is a cloud-native lakehouse architecture that supports both structured and unstructured data while connecting to existing regulatory systems.

Within this model:

- A data mesh approach assigns clear ownership to domain teams, who manage data products as reusable, auditable assets.

- A data fabric overlays governance, interoperability, and observability across domains, providing seamless access without compromising security.

Together, these patterns converge into a composable data ecosystem that scales AI models safely, ensures data lineage, and guarantees traceability across every decision.

According to Gartner’s 2026 Data Fabric Forecast, next-generation fabrics will unify AI observability, lineage, and access control under a single architecture.

Governance as Infrastructure

In 2026, regulators will no longer accept governance as an afterthought. Frameworks such as BCBS 239, GDPR, and OSFI’s Guideline E-23 have made data lineage and quality management non-negotiable.

Forward-looking FS leaders are embedding governance directly into their data platforms by:

- Implementing data catalogs and consent tracking systems to maintain transparency.

- Enforcing data quality service-level agreements (SLAs) to monitor accuracy and timeliness.

- Integrating retention policies and access logs that make audit trails verifiable at any time.

These practices form what can be called the AI trust layer, which is eesseentially a foundational layer of lineage, access control, and observability that ensures every AI-driven decision is explainable by design.

Key takeaway:

Your architecture is your compliance posture. In 2026, regulators won’t just assess your controls. They’ll examine your data lineage and decision logic. Treating architecture as a regulated, composable asset is how financial institutions build trust and scalability simultaneously.

Streaming Pipelines: Powering Real-Time Readiness

In 2026, real-time data movement will define the pace of business in financial services. The institutions that can sense, decide, and act in milliseconds — across customer, risk, and operational workflows — will lead in both performance and trust.

Leading banks are adopting Change Data Capture (CDC) for core systems, using schema registries for consistency, and pushing toward event-driven architectures that support microsecond response times.

These capabilities transform not only customer experiences but also operational efficiency. Real-time architecture becomes both a revenue enabler and a risk mitigator.

From Batch to Event-Driven Intelligence

Most financial organizations still operate with nightly or hourly batch pipelines that delay decisions and limit agility. The 2026 imperative is to shift to event-driven architectures — where data streams continuously, powering actions as events occur.

This evolution is made possible by:

- Change Data Capture (CDC) for capturing live updates from core systems.

- Schema registries that maintain consistency and quality across streaming domains.

- Microservice event hubs that allow modular scalability and reuse across functions.

- Streaming governance controls that embed lineage and validation into every data flow.

Together, these components create an infrastructure that’s observed, auditable, and adaptive –– a foundation for real-time AI and analytics that complies with regulatory demands while improving service responsiveness.

According to Gartner’s 2025 Data Engineering Outlook, by 2026, over 70 percent of financial institutions will adopt streaming architectures as a core modernization pillar, linking operations, risk, and customer experience under a single, real-time data fabric.

The result:

- Fraud decisions made in milliseconds, not minutes.

- Dynamic credit scoring that updates as customer behavior changes.

- Personalized offers triggered instantly within digital journeys.

These use cases illustrate that streaming pipelines are no longer a technical upgrade, they are a competitive necessity. They collapse latency between insight and action, enabling institutions to mitigate risk and capture opportunity at the same speed.

Key takeaway:

Streaming is the nervous system of modern financial services. Real-time readiness isn’t just about speed; it’s about relevance and resilience. From detecting fraud as it unfolds to dynamically adjusting credit limits or investment exposures, the ability to act instantly transforms decision quality and customer engagement alike.

In 2026, institutions that achieve real-time readiness won’t just move faster but build trust through transparency, responsiveness, and control.

Analytics Evolution: From Dashboards to Decisions

If 2025 was about dashboards, 2026 is about decision velocity. Financial institutions are moving from visualizing data to operationalizing it, transforming analytics from an insight engine into a real-time decision layer.

Augmented Analytics Becomes the Norm

The traditional model of static reporting is fading fast. In its place, augmented analytics, powered by machine learning, natural language querying (NLQ), and automated narrative generation, is helping executives make faster, better-informed decisions.

Key advancements include:

- AI-assisted dashboards that translate complex datasets into plain-language explanations.

- NLQ interfaces that let users ask “What drove the spike in Q2 defaults?” and receive data-backed, conversational answers.

- ML-powered anomaly detection that flags issues before they become financial or compliance risks.

According to Gartner’s 2025 Analytics Trends Report, by 2026, 70 percent of analytics interactions will be conversational — a shift that democratizes data literacy across business functions.

For financial institutions, this shift isn’t just technological but cultural. Data literacy has become a board-level KPI, defining how quickly teams can move from insight to action.

Real-Time and Edge Intelligence

Analytics is also moving closer to where customers and operations live: the edge.

With 5G, IoT, and hybrid cloud connectivity, banks can now deploy edge analytics to enable:

- Millisecond-level fraud detection in payments.

- Branch optimization based on real-time footfall and transaction data.

- Embedded financial insights within mobile apps and ATMs.

The fusion of edge and cloud analytics transforms how organizations operate, combining real-time responsiveness with enterprise-scale governance.

Visualization and Democratization

2026 will mark a turning point where analytics becomes an organizational capability, not a departmental one. To achieve this, financial services leaders are:

- Embedding self-service analytics into everyday workflows.

- Expanding data access frameworks while maintaining security and compliance.

- Investing in data literacy programs for business users to interpret and act on insights responsibly.

JPMorgan, for instance, has already piloted NLQ-enabled dashboards for credit and fraud analytics, reducing time-to-insight by over 40 percent and freeing analysts for higher-value tasks.

Key takeaway:

Turn analytics from reporting to revenue enablement. The institutions that shorten their “insight-to-action time” will outperform peers on customer retention, fraud loss reduction, and risk mitigation. Data-driven decision velocity is the new measure of competitive advantage.

RegTech as a First-Class Workload

In 2026, RegTech moves from compliance support to strategic infrastructure. For financial institutions under growing scrutiny from regulators and boards alike, regulatory technology is no longer a peripheral investment, but the operating system for trustworthy AI.

From Reporting to Continuous Assurance

Regulatory technology (RegTech) has traditionally been seen as a back-office function, producing evidence only when requested. That era is ending.

The next wave of RegTech will automate compliance continuously, not periodically. It will prove adherence through data, not documentation.

Leading institutions are now embedding RegTech capabilities directly into their AI and data platforms to automate:

- AML/KYC (Anti-Money Laundering / Know Your Customer) screening and risk scoring in real time.

- Sanctions checks and stress testing, powered by model-based simulations.

- Regulatory reporting, complete with lineage-backed “evidence packs” automatically generated and auditable at any point.

The result is a compliance function that operates at the same speed as innovation and that scales governance alongside AI experimentation.

AI Explainability by Design

Regulators in Canada, Europe, and globally are signaling a new direction: AI explainability will be required by design, not bolted on later.

The OSFI’s AI Principles, the EU AI Act, and forthcoming BCBS guidance converge on a shared expectation that every AI model must include transparency, traceability, and human oversight from the moment it is deployed.

According to Gartner’s 2025 Financial Services Outlook, by 2026, regulators will expect continuous evidence rather than periodic reports, forcing firms to rethink compliance from static reporting to dynamic validation.

This convergence of AI transparency, regulatory compliance, and data governance makes RegTech a first-class workload within every AI architecture — the connective tissue that ties innovation to accountability.

Key takeaway:

In 2026, RegTech is no longer a cost center for creating audit trails. It is the proof layer of trust that allows you to innovate without begging for forgiveness. The question is, are you building it into your core, or just bolting it on?

The financial institutions that embed continuous assurance will navigate 2026’s regulatory environment with agility and confidence, turning compliance from a cost centre into a differentiator.

AI Adoption Use Cases: Where Financial Institutions Can Start Today

Trends and frameworks only matter when they translate into measurable outcomes. The following use cases exemplify where financial institutions can begin applying AI and data responsibly in 2026, balancing innovation, risk, and regulatory readiness.

1. Instant Credit Decisioning

AI-driven scoring models are already improving underwriting, but the next step is to build explainability directly into the process.

By leveraging stream-based credit scoring pipelines, backed by lineage tracking and bias detection, banks can generate transparent, regulator-ready credit decisions.

Expected benefits:

- 40 percent faster loan approvals

- 25 percent fewer compliance exceptions

- Built-in adverse action notices to meet regulatory standards

2. Financial Health Insights for SMEs

Small and mid-sized enterprises (SMEs) remain underserved in predictive banking. By embedding AI-powered dashboards in business banking portals, institutions can help clients:

- Monitor cash flow and liquidity risk in real time

- Assess loan readiness and credit positioning

- Receive proactive alerts to prevent overdrafts or defaults

This not only improves SME retention but positions the bank as a financial partner, not just a provider.

3. Continuous Compliance Automation

Replace static regulatory reporting cycles with continuous evidence streams. Using lineage-enabled platforms, compliance teams can automatically attach proof of control adherence to every transaction or decision.

Benefits include:

- Reduced manual hours for compliance reporting

- Real-time alerts for policy breaches

- Full traceability for internal and external audits

4. ESG Data Integration

An emerging use case for 2026 is AI-driven ESG (Environmental, Social, and Governance) analytics.

By integrating ESG metrics into lending, investment, and risk models, institutions can meet sustainability mandates while improving risk-adjusted returns.

According to Gartner’s 2025 Banking Trends Report, ESG data integration will become a mandatory analytics capability by 2026, especially for capital markets and retail portfolios.

Every successful use case shares three attributes: measurable ROI, regulatory readiness, and transparent governance. 2026 won’t be about building the most advanced model. It will be about building the most explainable and profitable one.

Structuring for Scalable AI: Operating Model & Roles

Even with the right architecture and tools, sustainable adoption requires the right operating model. 2026 will redefine how financial institutions organize around AI, with governance, accountability, and cross-functional collaboration at the centre.

Federated but Governed

The most scalable model combines federated data ownership with central governance.

Domain teams own their data products, accountable for their quality, usability, and compliance, while a central platform team maintains shared infrastructure, access policies, and monitoring standards.

This “federated but governed” approach, aligned with Gartner’s Data Mesh Leadership Principles, empowers innovation without compromising consistency.

Embedded Risk and Privacy

Privacy and risk functions are shifting from after-the-fact audits to embedded controls within product squads.

By integrating privacy officers and risk managers directly into AI and data product teams, institutions ensure compliance “by design,” reducing downstream rework and regulatory exposure.

MLOps and Observability

AI models are no longer static artefacts but living systems that require lifecycle management.

Institutions are implementing:

- Model registries to track versioning and approvals.

- Bias testing frameworks to monitor fairness and drift.

- Rollback automation to decommission or revert non-compliant models safely.

The emerging role of an AI Assurance Office or Responsible AI Council ensures governance across model lifecycle stages, from design to decommission.

Leaders of financial services must redefine roles: from data custodians to value stewards.

Structuring for scale means embedding accountability, not adding bureaucracy. In 2026, governance will be a function of how teams operate, not just how they report.

Implementation Roadmap: A Year of Real Progress

By 2026, the question for every financial institution isn’t whether to scale AI, it’s how to do it responsibly, sustainably, and measurably. A practical roadmap transforms aspiration into execution, ensuring progress aligns with both business outcomes and regulatory expectations.

The most effective implementation plans are staged over 12–18 months, combining foundational groundwork, early pilots, and scale-up phases.

Quarters 1–2: Establish the Foundations

- Conduct a baseline maturity assessment using frameworks such as Gartner’s AI Maturity Model (2025) to identify data, governance, and talent gaps.

- Launch a data architecture pilot focused on one high-value domain (e.g., credit decisioning or risk monitoring).

- Establish a governance council and model inventory to define ownership, lineage standards, and explainability requirements.

Quarters 3–4: Operationalize Early Wins

- Deploy the first operational AI use case that delivers measurable business metrics (cost, risk, or customer experience) and includes an audit trail.

- Develop metadata and lineage capabilities that turn data assets into governed data products.

- Launch a cross-functional upskilling program for data, risk, and business teams to accelerate adoption readiness.

Year 2: Scale with Confidence

- Expand pilots to additional domains such as fraud detection, marketing triggers, and compliance automation.

- Federate domain ownership under clear accountability, while refining platform-wide governance.

- Embed continuous monitoring and model drift tracking within the MLOps pipeline.

- Deliver board-level reporting on AI KPIs, regulatory readiness, and cost-to-value metrics.

Throughout this journey, progress should be tracked using quantifiable indicators:

- Time-to-insight (speed of analytics impact)

- Model exception rate (trust and stability)

- Data-product reuse (efficiency and maturity)

- Cost per decision (ROI and scalability)

Finally, Avoid the “big bang” approach.

Build once, prove value early, and scale governance and adoption together. The institutions that start small but design for scale will lead in both compliance and competitiveness.

Measuring AI Adoption Impact Through KPIs and Real Value

AI accountability demands quantifiable success metrics. Financial institutions must show not only what they’ve implemented but how well those systems perform across business, operational, and regulatory lenses.

Operational Metrics

- Time-to-insight: how quickly data-driven intelligence reaches decision-makers.

- Data quality SLOs: benchmarks for accuracy, completeness, and timeliness.

- Report cycle time reduction: how automation shortens compliance or performance reporting cycles.

Business Outcomes

- Model stability and lift: sustained performance across multiple quarters.

- Fraud loss reduction: measurable declines in false positives and undetected anomalies.

- Customer retention and engagement: uplift in loyalty through personalized experiences and proactive insights.

Adoption Metrics

- Percentage of decisions informed by AI: tracking the extent of AI influence across functions.

- Analytics usage by business users: number of active non-technical users consuming AI-powered insights.

- Reduction in manual compliance hours: proof that automation translates into real efficiency gains.

Each KPI should be reported quarterly to both operational leaders and the board, reinforcing AI as a managed discipline, not a one-time project.

Final Takeaways: 5 Principles Guiding the 2026 Mindset

2025 was the year of discovery. 2026 is the year of discipline.

The shift from AI experimentation to AI accountability defines the next chapter for financial services. The institutions that succeed will be those that treat AI not as a novelty but as a regulated, measurable, and trusted operational system.

Five leadership principles defining 2026 for the financial services industry are:

1. AI is now operational, not experimental

Firms that embed governance, data readiness, and measurable value will dominate market trust and investor confidence.

2. Trust trumps novelty

Regulators and boards no longer ask “What did you build?”. They ask “How did you build it, govern it, and measure it?”

3. Foundations first, scale second

Data readiness, governance, and operating model maturity must precede model proliferation.

4. Business value is the north star

Sustainable advantage comes from embedding AI in day-to-day operations: customer, risk, and compliance alike.

5. AI is a strategic asset, not a cost centre

When executed responsibly, AI strengthens resilience, accelerates decisions, and amplifies competitive differentiation.

By the end of 2026, the real challenge at the board level will be how your institution can demonstrably trust, govern, and value its AI-powered decisions, and how you will report that to stakeholders.

FAQs

1. What’s the biggest barrier to AI adoption in financial services today?

Fragmented data and legacy architecture remain the largest roadblocks. Without unified, governed data platforms, AI models lack reliable inputs, making governance, explainability, and ROI measurement nearly impossible.

2. How can institutions ensure regulatory compliance while scaling AI?

Embed compliance “by design” through RegTech systems that continuously collect lineage evidence, automate model validation, and generate real-time proof of control adherence.

3. Where should financial institutions start in 2026?

Begin with one high-impact, low-risk domain such as fraud detection, credit decisioning, or compliance reporting and build governance maturity around that pilot before scaling.

4. What’s the most important metric to track AI success?

A combination of model stability (trustworthiness) and time-to-insight (business agility) offers the clearest view of adoption maturity and value realization.