Jump To Section

- 1 AI-Assisted Development Moves from Pilot to Production

- 2 The AI Opportunity to Bridge the Legacy-Modern Gap

- 3 Where the Change Is Already Happening

- 4 The 2026 Solution: AI-Assisted Engineering

- 5 Supporting Technologies for Financial Institutions to Leverage in 2026

- 6 Final Takeaways: The Strategic Imperative for Financial Institutions

The financial services industry stands at a pivotal moment where technological debt meets the demand for speed, security, and compliance. For decades, banks and insurers have relied on sprawling legacy systems written in COBOL and other outdated languages, systems that are stable but rigid, secure but slow to evolve.

As customer expectations, regulatory pressures, and competitive landscapes intensify, these organizations face a critical question: how can they modernize faster without sacrificing reliability and become future proof?

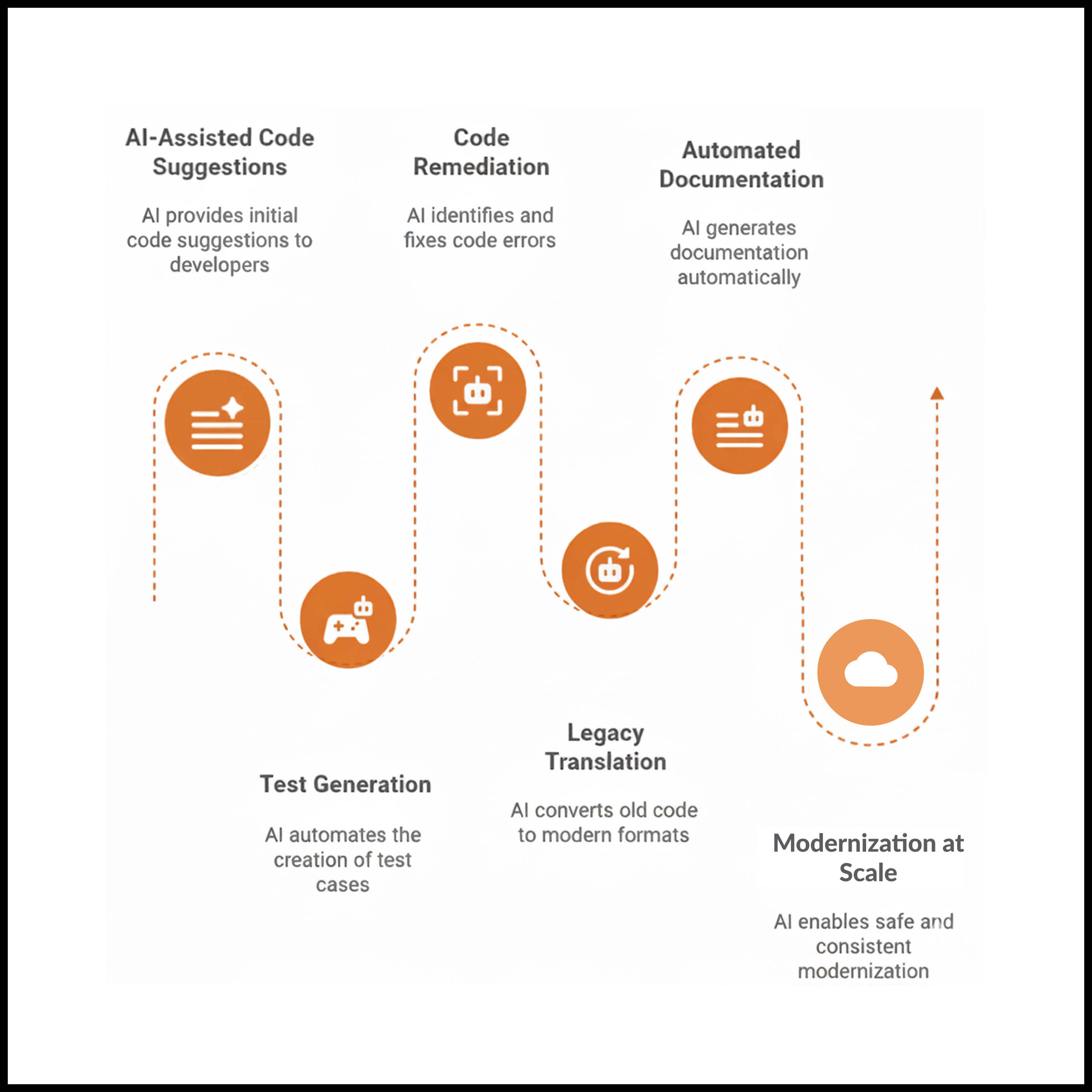

Artificial Intelligence is reshaping that answer. What began as AI-assisted code suggestions has matured into a full-fledged capability, AI-assisted engineering that extends across the software lifecycle: from test generation and code remediation to legacy translation and automated documentation. This new approach doesn’t just speed up development; it builds intelligence directly into the delivery pipeline, enabling teams to modernize safely, consistently, and at scale.

According to Forbes contributor David Parker, in The Future of AI in Financial Services (October 2024), AI-assisted engineering is poised to shift from pilot programs to production reality across financial institutions in the next 12 months. Organizations that harness it early will see shorter release cycles, lower technical debt, and more resilient systems, while those that delay risk being constrained by aging architectures and talent scarcity.

In this article, we explore how AI-assisted engineering is redefining software delivery in financial services, highlighting the trends, technologies, and strategic steps that will separate early adopters from laggards in 2026.

AI-Assisted Development Moves from Pilot to Production

For years, banks have run on the same engines that once made them untouchable, COBOL mainframes and tightly wired architectures. They were built for an era of stability, not speed. But the world has changed.

The 2026 Pressure to Ship Faster, Safer Apps

Customers now expect real-time everything, instant payments, live updates, seamless digital onboarding while regulations keep shifting faster than release cycles can handle. Every new product or API feels like pushing modern code through an aging, cautious machine. Deployments crawl, testing eats up weeks, and even a small tweak can trigger a maze of reviews.

In 2026, this isn’t just a tech problem but a business bottleneck. The question isn’t can banks build faster apps. It’s can they do it safely, without breaking trust?

That’s where AI-assisted development steps in: to help banks ship smarter, safer, and faster without rewriting their entire past.

The Weight of Legacy Systems

The heart of most banks still beats on COBOL. Stable but rigid, these systems resist integration and slow the rollout of digital products. Even small enhancements require deep system knowledge and weeks of testing.

The Talent Gap

The engineers who understand these legacy systems are retiring, while new talent prefers modern stacks and agile environments. This leaves banks with shrinking expertise and rising dependency on costly contractors.

The Cost of Maintenance and Compliance

According to SIG’s article: How Poor Maintainability Drains IT Budgets in Finance, “Maintaining old systems now consumes up to 70% of IT budgets, leaving little room for innovation. Compliance changes, often manual and repetitive, add to the drag, increasing both risk and cost.

Testing and Documentation Bottlenecks

Manual testing and outdated documentation make release cycles fragile. Each update introduces uncertainty, with limited visibility into coverage or traceability, a critical issue in a regulated ecosystem.

The AI Opportunity to Bridge the Legacy-Modern Gap

A bank’s core system still runs on COBOL solid, dependable, but frozen in time. Every update feels like surgery on a living machine. That’s where AI-assisted engineering steps in, not to replace developers, but to pair with them and make modernization faster, safer, and less painful.

Instead of rewriting everything from scratch, the AI acts like a smart translator. It reads legacy code, understands its intent, and begins converting it piece by piece into modern, modular components. At the same time, it documents what it learns, automatically creating the knowledge base teams wish they’d had years ago.

AI-Assisted Modernization in Practice

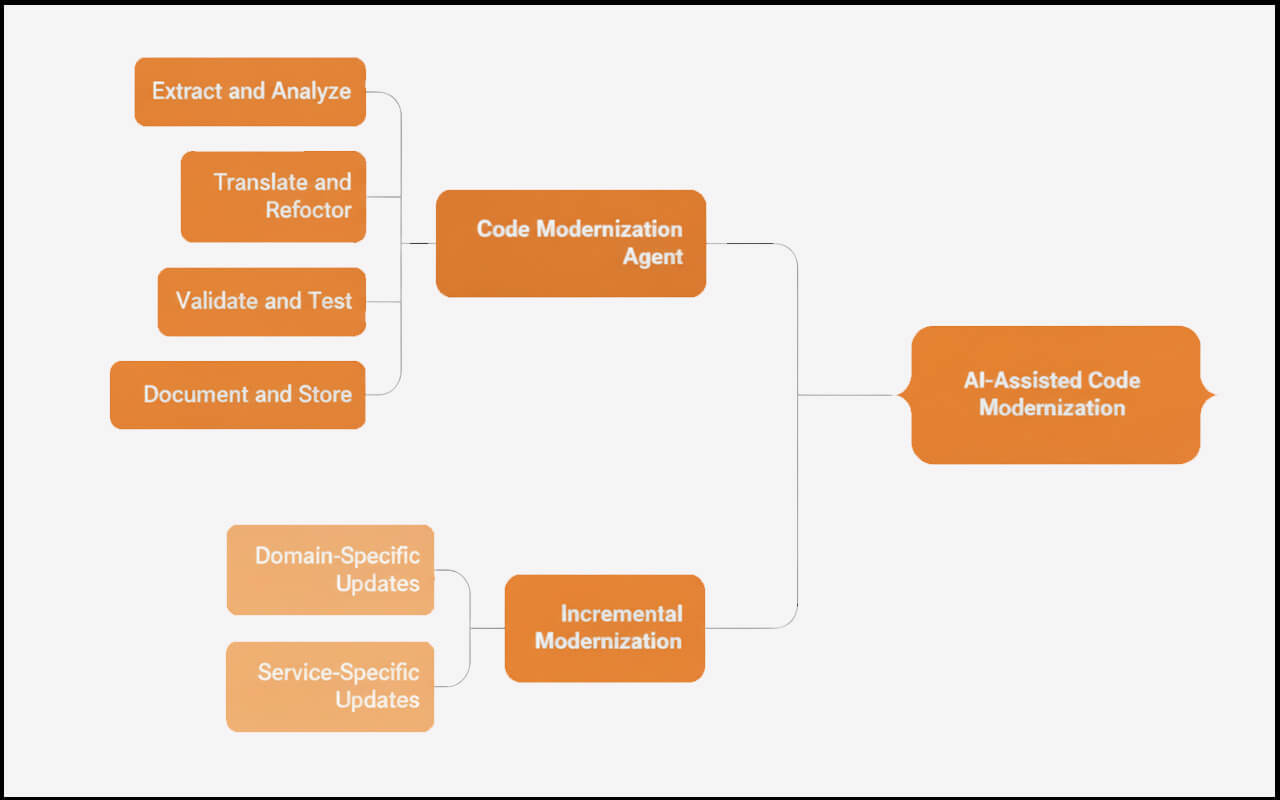

A custom Code Modernization Agent like ours takes this transformation to a technical level that goes beyond simple code translation. It doesn’t just rewrite COBOL to Java or .NET; it reconstructs the architecture intelligently.

1. Code Understanding

Performs abstract syntax tree (AST) and control-flow analysis to extract business logic, data models, and dependencies. It maps out which modules can safely decouple without breaking system integrity.

2. Automated Translation

Uses a hybrid of rule-based parsing (for syntax accuracy) and contextual AI reasoning (for logic understanding) to generate clean, modern equivalents.

3. Refactoring and Optimization

Identifies redundant logic, obsolete libraries, and tight coupling, then restructures them into service-based or event-driven components.

4. Validation and Testing

Runs automated regression and parity tests to ensure that the new code behaves exactly like the old system just faster, lighter, and easier to maintain.

5. Documentation and Traceability

Captures transformation logs, API mappings, and data lineage automatically, creating an audit-ready modernization trail.

The result? Banks can modernize their systems incrementally, one domain, one service at a time, without halting business operations.

Aligning AI-Driven Automation with Regulatory and Security Needs

AI isn’t meant to move fast and break things, not in banking. When built into secure DevSecOps pipelines, these tools can actually make every change safer and more accountable. Every line of AI-generated code is traced, tested, and logged. Documentation updates automatically, security scans run in the background, and audit trails build themselves.

The result? Banks stay compliant with ever-changing regulations while cutting down the time and cost it takes to prove it.

The Business and Operational Benefits for Financial Institutions

The payoff is huge, systems become faster, stronger, and smarter. Banks can ship updates in weeks instead of months, spend less keeping old systems alive, and catch more bugs before they ever reach production. What used to be a slow, multi-year modernization slog turns into a continuous, AI-powered cycle of improvement.

The result is an organization that moves quicker, saves more, and innovates without breaking what already works.

Testing and Documentation Bottlenecks

Every release in a bank feels like holding your breath. Before a single update can go live, teams scramble through manual test cases, scattered spreadsheets, and half-written documentation that never quite matches the latest code. Testing takes weeks, and documentation lags months behind. No one’s to blame; the process was built for a slower time. But today, speed is everything. That’s where AI-assisted engineering changes the game.

Where the Change Is Already Happening

Instead of engineers spending hours writing and updating tests, AI steps in as the silent QA partner. It scans code, reads requirements, and automatically builds the right tests; unit, integration, regression whatever the system needs. As applications evolve, the AI keeps those tests alive, adjusting locators, fixing scripts, and regenerating what breaks.

At the same time, a Documentation Agent makes sure the knowledge never gets lost again. It continuously listens to the codebase capturing architecture changes, new endpoints, dependencies, and logic updates and turns that into clear, versioned documentation. Think of it as a real-time historian for your software, one that finally ends the cycle of outdated specs and missing diagrams.

As a result, releases stop feeling like last-minute marathons. Teams can test faster, update confidently, and onboard new developers without losing time chasing context. Testing and documentation become part of the continuous delivery rhythm, not the bottleneck that breaks it.

The 2026 Solution: AI-Assisted Engineering

Think of AI-assisted engineering as the new co-pilot for development teams, one that quietly automates the repetitive, risky parts of software delivery so engineers can focus on what really matters: building, improving, and shipping.

It works across the entire lifecycle from testing and remediation to modernization and documentation, bringing speed, accuracy, and consistency that human-only teams struggle to maintain. It’s powered by a mix of generative AI models, automated pipelines, and governance frameworks that ensure everything stays secure, compliant, and traceable.

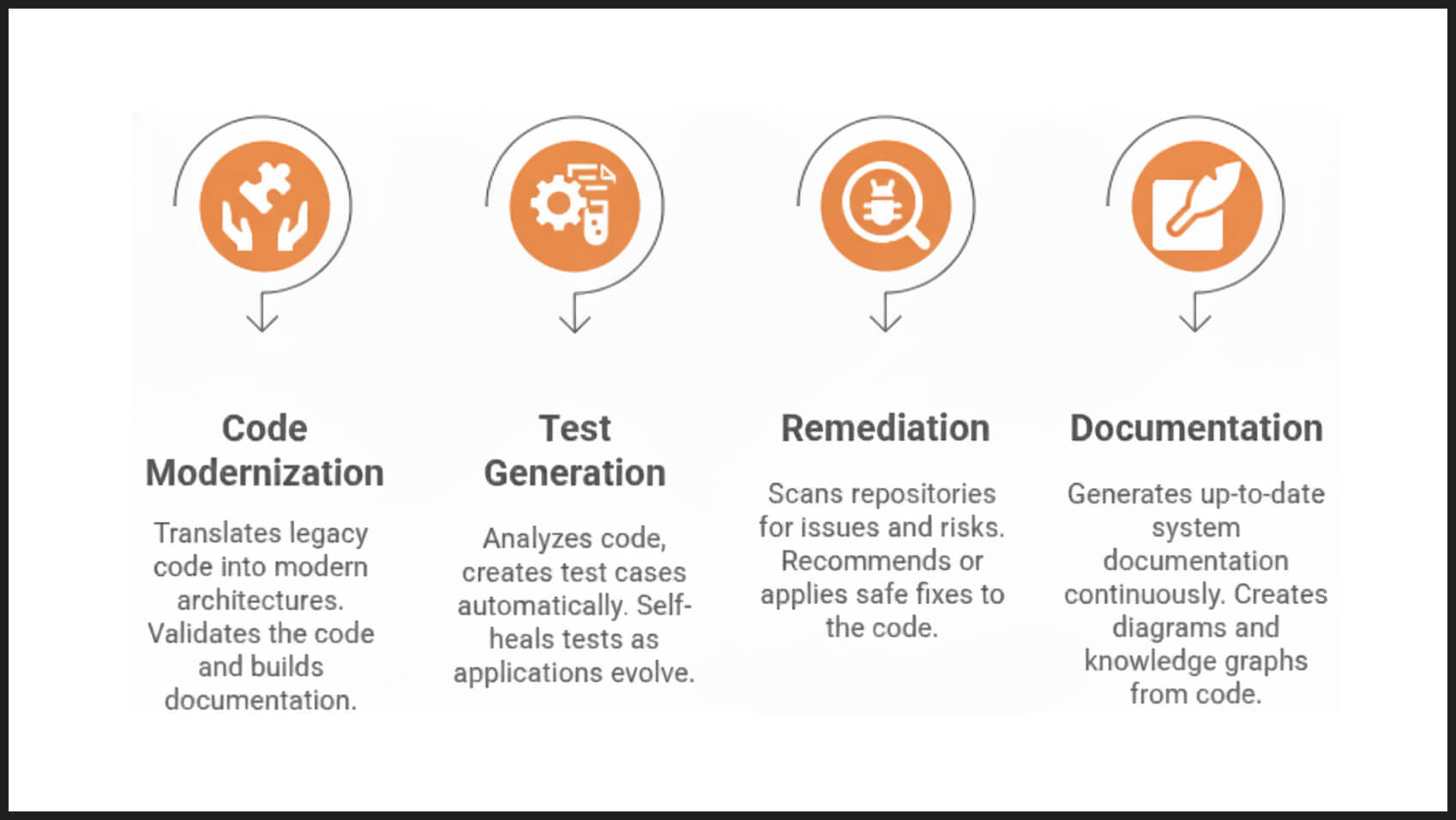

Behind the scenes, a suite of specialized AI agents runs the show:

- Code Modernization Agent – translates legacy COBOL or monolithic code into modern architectures, validates it, and builds living documentation.

- Test Generation Agent – analyzes new code or requirements, creates test cases automatically, and self-heals tests as apps evolve.

- Remediation Agent – scans repositories for performance issues, security risks, or outdated dependencies, and recommends or applies safe fixes.

- Documentation Agent – continuously generates up-to-date system documentation, diagrams, and knowledge graphs from live codebases.

Together, these agents form a connected intelligence layer that accelerates delivery without sacrificing security or control.

Supporting Technologies for Financial Institutions to Leverage in 2026

In banking, trust isn’t optional and that extends to the technology stack. Our AI-assisted engineering framework blends proven Natural Language Processing (NLP) methods with the latest advancements in Large Language Models (LLMs) to strike the right balance between innovation and control. Add Switch

Where interpretability, data privacy, and consistency are critical, our agents rely on tested NLP techniques like semantic parsing, entity recognition, dependency mapping, and rule-based classification to analyze and refactor code safely within closed environments. When the use case demands higher contextual understanding (like code summarization or intent extraction), LLMs are selectively integrated under strict governance isolated from sensitive data and monitored within secure on-prem or private-cloud deployments.

When precision, privacy, and predictability matter most, we rely on traditional NLP techniques, the tried-and-tested tools that safely analyze code structures, map dependencies, and extract business logic inside secure environments.

But when understanding context, refactoring complex logic, or rewriting documentation in plain language is required, we switch gears. That’s where LLMs come in; bringing the ability to reason across entire systems, summarize intent, and make sense of patterns no rule-based system could capture on its own.

Each of our agents from the Code Modernization Agent to the Test Generation Agent, Remediation Agent, and Documentation Agent is developed using this hybrid AI approach. They combine deterministic NLP pipelines with generative reasoning models, ensuring that the results are explainable, verifiable, and production-ready, not experimental. This approach mirrors the design principles behind our FX Agent, where NLP-driven intelligence handles structured, domain-heavy data while LLMs enhance understanding and contextual recall.

Together, they demonstrate that AI doesn’t have to be reckless to be powerful, it just has to be engineered responsibly.

Final Takeaways: The Strategic Imperative for Financial Institutions

Financial institutions are entering a new era where software is not just written, it is engineered intelligently. AI-assisted development transforms traditional coding into a continuous, data-driven process that learns, optimizes, and governs itself. This shift reduces dependency on scarce legacy skills, accelerates modernization, and embeds compliance directly into every release cycle.

To remain competitive, organizations must:

- Adopt AI-assisted engineering early to modernize legacy systems incrementally and safely.

- Build governance around AI tools to ensure transparency, auditability, and regulatory trust.

- Invest in hybrid talent models, combining human expertise with AI augmentation.

- Scale modernization continuously, integrating AI across testing, remediation, and documentation.

The institutions that embrace this evolution will not only reduce technical debt but also gain a sustainable edge in speed, security, and innovation, defining the next chapter of digital transformation in financial services.