Jump To Section

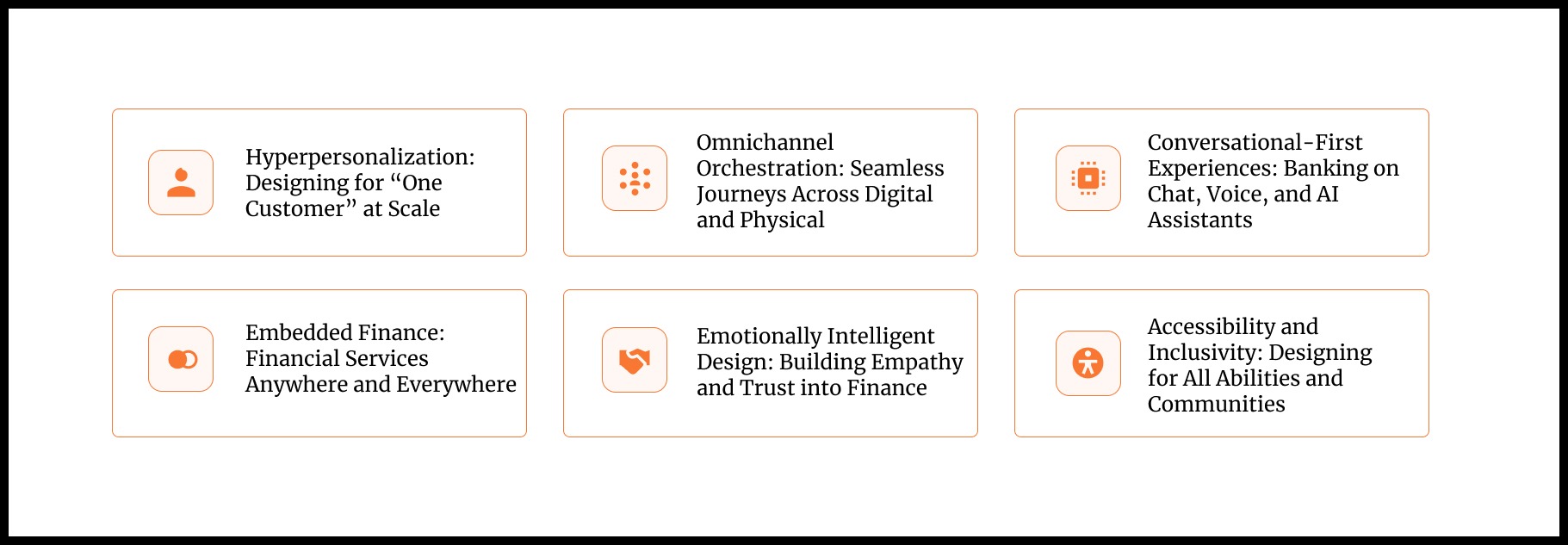

- 1 Why These Financial Services Trends Will Matter for Growth and Customer Experience in 2026

- 2 1. Hyperpersonalization: Designing for “One Customer” at Scale

- 3 2. Omnichannel Orchestration: Seamless Journeys Across Digital and Physical

- 4 3. Conversational-First Experiences: Banking on Chat, Voice, and AI Assistants

- 5 4. Embedded Finance: Financial Services Anywhere and Everywhere

- 6 5. Emotionally Intelligent Design: Building Empathy and Trust into Finance

- 7 6. Accessibility and Inclusivity: Designing for All Abilities and Communities

- 8 Final Takeaways: Strategic Investments into the Top Financial Services Trends for 2026

- 9 FAQs

Financial services are undergoing a design revolution. As we head into 2026, banks, insurers, payments providers, and wealth managers are reimagining customer experiences to win loyalty in a competitive, digital-first era.

Six key design trends are emerging as game-changers.

Below, we explore each trend with recent data, insights, and concrete examples showcasing how they address rising customer expectations and leverage new technologies to position firms that embrace them as leaders.

Why These Financial Services Trends Will Matter for Growth and Customer Experience in 2026

Customer experience (CX) has a direct impact on growth. Banks that excel in personalization and advocacy, for example, are seeing revenue grow 2.6× faster in North America than their peers.

Meanwhile, digital disruption and evolving demographics are raising the bar for design. Surprisingly, 84% of banking customers globally say they’d switch to a bank that offers personalized financial advice and insights powered by AI.

At the same time, 55% of U.S. consumers now use mobile apps as their primary banking method, yet 96% still rate their bank’s digital experience as good, indicating high expectations across channels.

Financial stress is also at all-time highs, with 42% of Canadians naming money as their top source of stress (more than health, work, or relationships). In this landscape, human-centric, inclusive design is not just altruism but a competitive imperative.

Let’s dive into the trends shaping the financial services industry in 2026 and how leading institutions are bringing them to life.

1. Hyperpersonalization: Designing for “One Customer” at Scale

Hyperpersonalization tailors products, services, and experiences to individual customers in real time. Today’s banking customers expect highly personalized, relevant interactions, similar to the personalized recommendations they receive from platforms like Netflix.

Why It Matters in 2026

Data and AI enable financial firms to anticipate customer needs and deliver one-to-one experiences. Studies show that banks excelling in personalization see 2.6 times faster revenue growth and higher customer loyalty. Customers who feel understood tend to hold more products and refer others, directly boosting lifetime value.

Rising Customer Expectations

A 2025 global survey found that 84% of banking customers would switch banks for timely, personalized advice, and 74% would stay loyal to banks offering tailored insights and automated money management based on daily habits. In North America, where personalization is the norm in other industries, banks are expected to proactively support customers with relevant alerts and recommendations.

Industry Examples

- RBC’s NOMI Chatbot: Uses AI to analyze spending patterns and provide individualized budgeting insights, acting as a personal finance coach in a mobile app.

- Bank of America’s Erica: Delivers billions of proactive, personalized notifications such as cashback deals, upcoming bills, and rewards eligibility, enhancing engagement and customer satisfaction.

- Regional Banks: Many smaller banks unify customer data into cloud platforms to create a 360° customer view and deploy AI models that recommend the “next best actions” tailored to each client.

The Challenge and Opportunity for Financial Institutions

True hyperpersonalization requires breaking down data silos across banking, credit, investments, and insurance, while ensuring privacy and security. Advances in cloud technology and analytics make this feasible, positioning 2026 as a breakthrough year for “segment of one” marketing in finance.

North American banks are investing heavily in AI personalization, often partnering with fintechs to deliver contextual experiences across channels. Personalized banking, such as offering a credit card at the right life moment or tailored loan options within accounting software, builds trust and deepens customer relationships. Banks that fail to adapt risk losing relevance and market share. As one leader put it, “If we miss the emotional context, we lose not just loyalty, but relevance.”

2. Omnichannel Orchestration: Seamless Journeys Across Digital and Physical

Omnichannel orchestration ensures customers experience a unified journey across all banking channels: mobile apps, websites, branches, ATMs, and call centers. It allows customers to start a process in one channel and finish it in another without disruption or repeated information.

Why Omnichannel Matters in 2026

As digital channels dominate, customers still value integrated experiences that combine digital convenience with human interaction. In North America, 55% of bank customers primarily use mobile apps, yet branches and ATMs remain relevant for many. High satisfaction rates (96% for digital experience and 94% for access across channels) show that customers expect seamless transitions and consistent service no matter the channel.

Omnichannel design boosts customer retention; financial companies with strong omnichannel engagement retain 89% of customers on average, compared to only 33% for weaker performers. For banks, this means investing in service design orchestrating entire customer journeys rather than isolated touchpoints, creating continuity and improving loyalty.

Key Omnichannel Strategies for Financial Institutions in 2026

- Investing in journey orchestration software and CRM integrations to enable smooth handoffs between channels.

- Integrating service design within the team to map complete customer journeys (e.g., mortgage application, financial planning) to ensure all channels contribute cohesively.

- Breaking down legacy system barriers with API-driven middleware and data lakes to provide real-time, shared customer data.

Examples of Omnichannel Excellence

- BMO’s Goal Tracking: Customers can set and track savings goals seamlessly across branches, email, and mobile app, receiving personalized guidance regardless of interaction channel.

- Bank of America’s Erica: This AI assistant not only answers questions but can schedule appointments with bankers, blending digital convenience with human support.

- Canadian Banks’ AI Scheduling: Some banks enable customers to schedule branch appointments via mobile apps, often guided by AI assistants, enhancing channel integration.

In 2026, omnichannel orchestration is essential for delivering convenience and efficiency. Customers expect frictionless transitions between digital and physical channels, and banks that deliver this will deepen relationships, reduce dropped interactions, and gain a competitive edge.

Even as digital channels dominate, 2026 will be the year true omnichannel orchestration comes to fruition in financial services. Omnichannel design means customers can move fluidly between mobile apps, websites, branches, ATMs, and call centers with unified experiences and information. It’s about orchestrating every touchpoint so the whole journey is seamless: start a process in one channel, finish it in another, without ever feeling a disconnect.

3. Conversational-First Experiences: Banking on Chat, Voice, and AI Assistants

Conversational banking uses chatbots, voice assistants, and messaging interfaces as primary ways customers interact with financial institutions. Instead of navigating menus or forms, users simply ask or converse via text or voice to get tasks done. Advances in AI, especially large language models, have made these bots more capable and human-like. For institutions looking to double ROI, this is what a humman-centered design strategy must look like.

Why It Matters in 2026

By 2026, conversational banking is a mainstream expectation. It offers 24/7 convenience, instant answers, and faster service without waiting on hold. About 64% of customers value 24/7 availability, and 65% prefer self-service tools for simple tasks. Banks are expected to spend over $9 billion globally on AI chatbots by 2025, aiming to save millions of work-hours in call centers.

Key Examples of Conversational Banking

- Bank of America’s Erica: Launched in 2018, Erica is the most widely used virtual financial assistant, assisting nearly 50 million users with 3 billion interactions. It handles bill reminders, transaction searches, and more, with a 98% success rate without human escalation. Erica also supports employees internally, reducing helpdesk calls by half.

- TD Bank’s Clari: An AI chatbot integrated into the TD mobile app, Clari answers everyday questions in natural language, enhancing customer convenience.

- CIBC’s AI Voice Assistant: Recognized with a 2025 Digital CX Award, this assistant handles telephone banking inquiries and smartly routes complex issues to human agents with context preserved, improving resolution speed and reducing frustration.

- Smart Speaker and Messaging Integration: Some banks enable customers to check balances or send payments via smart speakers (e.g., Alexa) or messaging apps, expanding conversational banking beyond traditional platforms.

Design and UX Best Practices in the Financial Industry

Successful conversational experiences in 2026 focus on natural, trustworthy interactions that do more than answer queries—they execute transactions and provide guidance. Best practices include:

- Quick action suggestions anticipating customer needs.

- Humanizing tone with empathetic language.

- Seamless handoff to human agents when needed, preserving chat history.

The Future of Conversational Banking

Looking ahead, expect voice-authenticated banking using biometrics and deeper integration with wearables and vehicles. Conversational AI also promotes financial inclusion by aiding customers with low literacy or visual impairments through voice interaction.

Financial institutions balance automation with human touch, using “digital empathy” to detect when human intervention is required. This synergy frees human advisors for complex interactions and defines customer experience leadership in 2026.

4. Embedded Finance: Financial Services Anywhere and Everywhere

Embedded finance integrates banking, payments, lending, or insurance services into non-financial platforms invisibly. Consumers can access financial products within everyday apps or websites without visiting a bank directly. This trend is rapidly growing and reshaping how financial services are delivered. Study these 3 embedded-intelligence plays to learn how to transform financial products into growth engines.

Why Embedded Finance is Critical in 2026

The U.S. embedded finance market is projected to quadruple from $75 billion in 2023 to $236 billion by 2029, growing at a CAGR of about 28%. Globally, over 80% of the embedded finance opportunity remains untapped, signaling vast growth potential. Embedded finance also supports financial inclusion by reaching underserved customers through familiar platforms.

Notable Examples of Embedded Finance

- Apple & Goldman Sachs: Apple launched a high-yield savings account within the Apple Wallet app, quickly amassing over $10 billion in deposits in four months, offering seamless banking without leaving the device.

- Shopify Capital & Shop Pay Installments: Shopify integrates embedded lending and payment plans directly into its e-commerce platform, providing merchants and customers easy access to finance at checkout.

- Amazon & Bank Partnerships: Amazon offers small businesses rotating credit lines via its seller portal in partnership with banks like Bank of America, blending banking services into e-commerce.

- Travel Insurance on Booking Sites: Platforms like Expedia and Air Canada offer one-click travel insurance during booking, embedding insurance seamlessly into the purchase journey.

- Tesla & Ford Embedded Insurance and Financing: Tesla offers auto insurance to car owners based on driving data, while Ford embeds vehicle financing options within its car browsing experience.

- Banking in SaaS Platforms: Vertical SaaS providers embed financial tools like business checking accounts and payment processing, enabling small businesses to manage finances within their software.

Design and Regulatory Considerations

Embedded finance demands invisible, seamless UX with instant approvals and contextual offers. Open banking standards and regulatory frameworks in Canada and the U.S. are evolving to support secure data sharing and consumer protection. Transparency about who holds deposits or provides loans remains crucial.

The 2026 Outlook

Embedded finance will deepen, with more non-financial brands launching financial products. Banks will focus on becoming the “engine” inside other ecosystems, delivering services via APIs and SDKs. This shift means finance is available wherever customers spend time, offering unprecedented convenience and new growth opportunities.

5. Emotionally Intelligent Design: Building Empathy and Trust into Finance

Emotionally intelligent design creates digital and physical financial experiences that understand, respond to, and anticipate customers’ feelings. It focuses on empathy, trust, and emotional impact rather than just functionality.

Importance in 2026

With financial stress at an all-time high: 42% of Canadians cite money as their top stress source—designing for emotions is crucial. Emotionally intelligent CX builds confidence, reduces anxiety, and strengthens customer relationships, differentiating financial institutions in a competitive market.

Key Elements and Examples in the Financial Sector

- Real-Time Sentiment Routing: AI detects customer frustration in voice interactions, routing callers to empathetic human agents to prevent escalation.

- Financial Health Scores: Apps provide personalized tips based on users’ financial confidence, starting conversations about feelings alongside numbers.

- Humanized Language: Messaging avoids judgmental or jargon-heavy language, fostering openness and reducing shame in sensitive contexts like debt collections.

- Trust and Security Perception: Interfaces display reassuring security indicators and transparency about AI use to build confidence.

- Gamification and Rituals: Celebrating milestones with animations or badges encourages positive emotions and engagement.

- Behavioral Economics Principles: Using social proof and framing nudges customers toward better financial decisions, reducing churn.

Looking Ahead

In 2026, banks will enhance AI and staff empathy training, proactively reaching out to customers showing signs of distress. New CX metrics will measure emotional impact, helping identify areas for improvement beyond traditional analytics.

Emotionally intelligent design transforms finance from a cold transaction to a supportive partnership, fostering trust and loyalty in uncertain times.

6. Accessibility and Inclusivity: Designing for All Abilities and Communities

With about 22% of the North American population living with disabilities, accessible design is both a legal requirement and a market opportunity. People with disabilities control over $2.6 trillion in disposable income in North America alone.

Regulatory Landscape for Accessibility in the Financial Sector

Canada’s Accessible Canada Act aims for barrier-free services by 2040, with penalties for non-compliance. The U.S. sees rising ADA lawsuits targeting inaccessible digital services. Leading banks have multi-year accessibility roadmaps and dedicated teams to ensure compliance and inclusivity.

Inclusive Design in Practice

- Digital Accessibility Features: Compliance with WCAG 2.1 AA standards, including screen reader support, high contrast modes, scalable text, and captions.

- Assistive Technology Integration: Audio guidance at ATMs, TTY services for telephone banking, video relay interpreting, and voice command features.

- Accessible Physical Spaces: Branches equipped with wheelchair ramps, automatic doors, lowered counters, hearing loops, and braille keypads.

- Cognitive Accessibility: Simplified app modes, dyslexia-friendly fonts, clear language, and step-by-step guidance for neurodiverse users.

- Human Assistance: Specialized support lines, sign language interpreters, and in-branch services remain essential.

- Multilingual Support and Cultural Sensitivity: Offering content in multiple languages and culturally relevant materials to serve diverse communities.

Business Case and Future Trends

Accessible design expands the customer base and improves experiences for all users (the curb-cut effect). Universal design features like adjustable fonts and dark modes benefit everyone. Inclusivity also addresses underserved communities, enhancing trust and financial inclusion.

Accessibility and inclusivity are mainstream priorities in 2026. Financial institutions that lead in this area avoid legal risks, unlock growth, and build goodwill by ensuring everyone can access and benefit from their services.

Final Takeaways: Strategic Investments into the Top Financial Services Trends for 2026

The financial services sector is on the cusp of a design renaissance. These six trends, hyperpersonalization, omnichannel orchestration, conversational interfaces, embedded finance, emotionally intelligent design, and accessibility, are interrelated and reinforcing. Together, they point toward a financial experience that is smarter, more seamless, more human, and available anywhere to anyone.

Investing in design and customer experience innovation is not a cost center, but a growth strategy. Each trend carries strategic questions.

Are we leveraging our data to truly know our customers?

Is every channel integrated to sing from the same song sheet?

Can our customers talk to us as easily as they text a friend?

Are we present in the ecosystems where our customers spend time?

Do our digital products make our customers feel understood and confident?

Can every customer access our services without barriers? These are the questions that will separate industry leaders from laggards in 2026.

Encouragingly, North American institutions, from the biggest banks to nimble fintechs, are already pioneering answers. We see it in the stats, the case studies, and the awards being won. The upside is enormous: higher loyalty, expanded markets, and a brand reputation as a financial partner that genuinely improves lives. As the data shows, delighting customers and making finance more inclusive isn’t just good ethics, it’s good business.

FAQs

Why does design matter more than features in 2026?

Because trust, simplicity, and emotional intelligence drive customer loyalty more than standalone functionality.

What are the biggest risks with AI-driven design in financial services?

Over-personalization, bias, and dead-end experiences. These can be mitigated with transparency, inclusivity, and guaranteed human fallback.

How can financial institutions start implementing these design trends?

By mapping critical customer journeys, launching personalization pilots, and embedding accessibility into the design system.