Jump To Section

- 1 Why Banks Face the Core Modernization Dilemma

- 2 Legacy Core Banking Challenges: Why Status Quo Is Not Sustainable for Banks

- 3 Core Modernization Pathways for Banking: Incremental Upgrades vs. Full System Replacement

- 4 Vendor Landscape for Core Modernization in Banking: Leading Platforms and Technologies in 2025

- 5 Recommended Banking Modernization Roadmap: 7 Steps to Execute with Confidence

- 6 Implementation Best Practices and Modernization KPIs for Banks

- 7 Case Studies: Banks That Tackled Core Modernization

- 8 Lessons from Banking Industry Leaders

- 9 Final Takeaway: Positioning Your Bank For Next-Generation Growth

By 2028, outdated banking systems are projected to cost global banks over $57 billion annually, up from $36.7 billion in 2022. According to Thought Machine and IDC, 98% of banks are planning for core banking modernization to upgrade their systems within the next three years.

Legacy systems aren’t just slowing innovation—they’re consuming budgets, compounding technical debt, and exposing institutions to avoidable risk.

The challenge isn’t recognizing the need for modernization—it’s determining the optimal path forward:

Should you pursue incremental upgrades, undertake a full system replacement, or adopt a hybrid approach?

This article breaks down each pathway—highlighting the trade-offs, lessons from banking leaders like RBC, JPMorgan, and Zions, and a core banking modernization roadmap grounded in real-world execution built to inform your decision-making process.

Why Banks Face the Core Modernization Dilemma

The core modernization for banking dilemma stems from the tension between maintaining legacy systems that are deeply embedded in banking operations and the pressing need to adopt modern technologies that meet evolving market demands.

Why Banks Struggle with Legacy Systems

Legacy systems—often decades old, built on monolithic mainframe architectures, and designed for batch processing and limited connectivity—are increasingly incompatible with the demands of modern banking.

Modern banking demands:

- Real-time payments

- Agile product launches

- Open banking APIs

- Seamless omnichannel experiences

However, outdated core platforms remain deeply embedded in operations, creating a dilemma: upgrade incrementally or replace entirely?

The complexity of these systems—heavily customized, poorly documented, and reliant on aging talent pools—makes even small updates costly and risky.

The Cost of Staying Still

Banks trapped in legacy cycles face more than technical debt:

- High maintenance costs consume large portions of IT budgets

- Limited agility slows time-to-market for new products

- Inflexible architectures make compliance updates painful and slow

- Customer experience suffers—from onboarding to service delivery

At the same time, regulatory expectations are rising—demanding more frequent updates, stronger security, and greater transparency. Legacy systems simply weren’t built for this kind of adaptability.

Modernization Isn’t Risk-Free

While the need for change is clear, the path forward often isn’t for most banks:

- A full core replacement promises long-term benefits but comes with massive risk, cost, and potential business disruption.

- Incremental modernization is safer and more flexible—but often takes years and creates temporary complexity by running old and new systems side by side.

On top of that, talent availability is a real constraint. Banks must find professionals skilled in both legacy systems and modern platforms, which makes project resourcing difficult. Many vendors profit from maintaining the status quo, offering limited incentives to support transformative change.

Ultimately, banks face a strategic decision: continue to invest heavily in maintaining aging platforms with limited scalability or embark on a modernization journey that aligns with their long-term business strategy, enhances operational efficiency, and positions them competitively in a rapidly evolving financial landscape. This dilemma is central to the future viability of financial institutions in North America and beyond.

Legacy Core Banking Challenges: Why Status Quo Is Not Sustainable for Banks

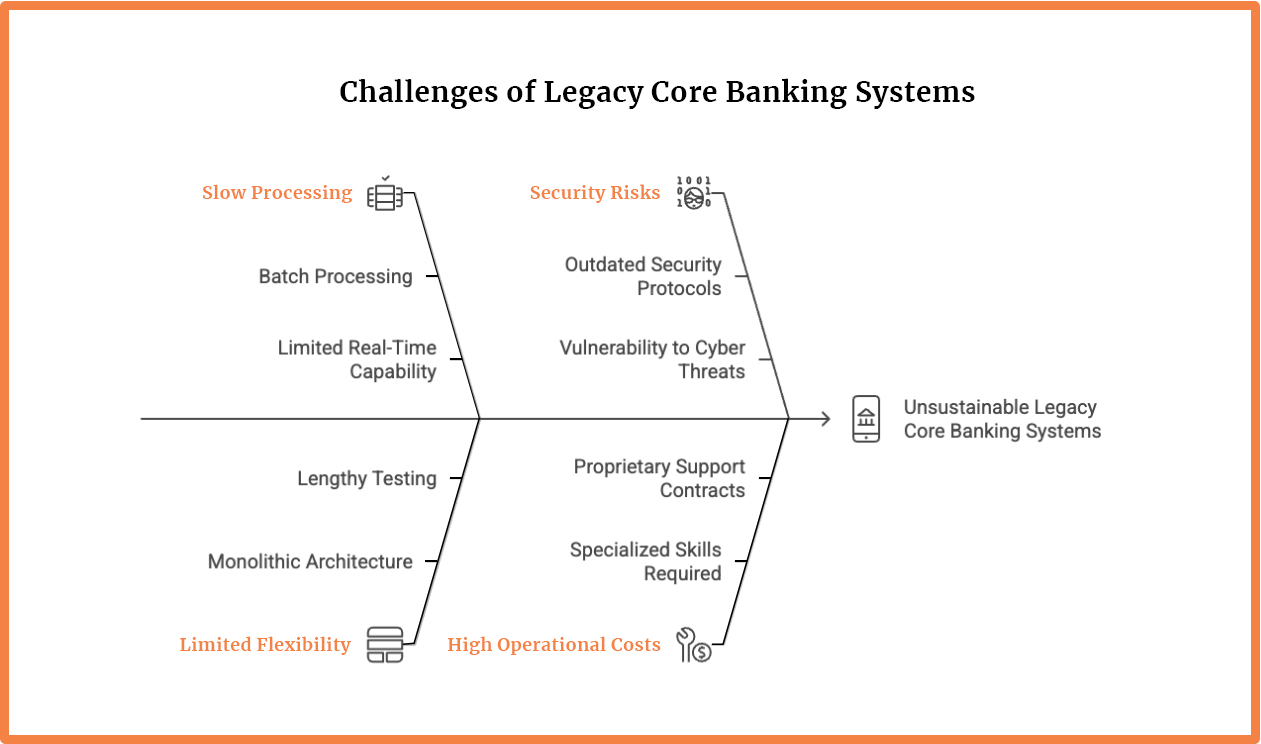

Legacy core banking systems are plagued by several issues:

Slow Processing and Limited Real-Time Capability

Traditional core systems often rely on batch processing, updating transactions in overnight cycles rather than in real time. Many older cores “do not run in real-time”, which constrains banks from offering true 24/7 instant services.

Limited Flexibility and Agility

Legacy cores were not built for the open, connected financial ecosystem of today. Their monolithic architectures mean that adding a new product or feature can require modifying code in multiple places and lengthy testing to ensure nothing breaks.

In practice, big banks have found that simple offerings (like a combined view of accounts) required multi-year projects because customer data sat in separate legacy systems.

Heightened Security and Compliance Risks

As systems age, they become harder to secure. Legacy cores may have outdated security protocols and are not designed to withstand modern cyber threats.

Security vulnerabilities in legacy tech pose serious threats: any breach of the core could compromise millions of customer accounts.

Operational Cost and Technical Debt

Legacy systems are notoriously expensive to maintain. The hardware (mainframes) and software require specialized skills and often proprietary support contracts. Over years, banks layer numerous patches and workarounds, leading to a high “technical debt” load that drains IT budgets.

The use of aging platforms limits a bank’s ability to innovate and provide personalized services, leading to a loss of market share and revenue.

To address these challenges, banks must consider core banking modernization. This involves replacing or upgrading legacy systems with modern, cloud-based systems that are scalable, flexible, and secure.

By doing so, banks can streamline operations, enhance data security, and offer innovative solutions that meet the evolving needs of their customers.

Core Modernization Pathways for Banking: Incremental Upgrades vs. Full System Replacement

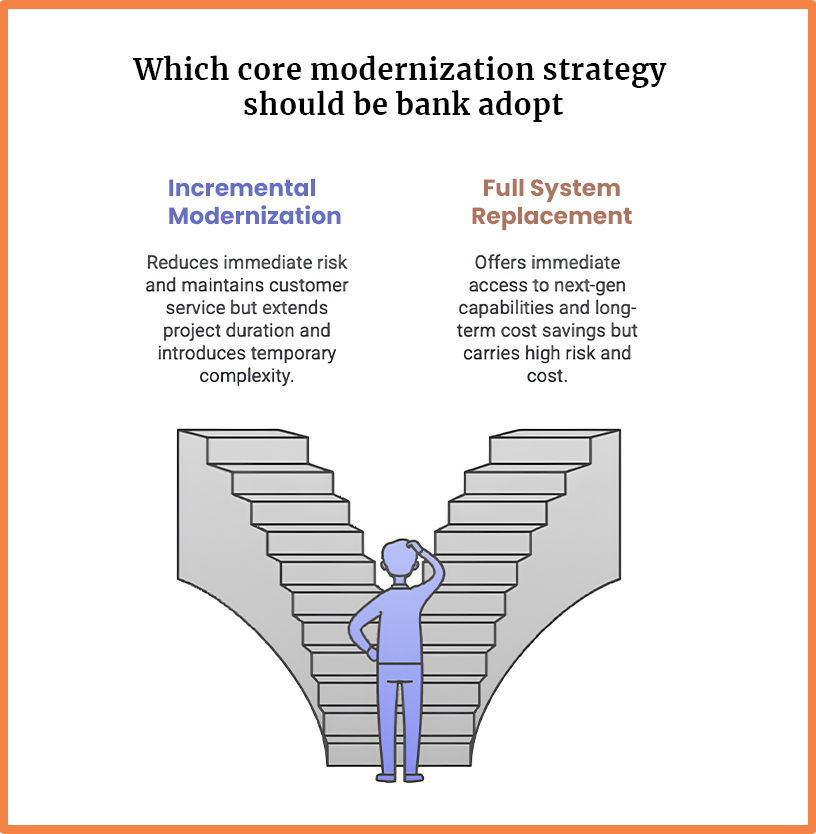

When embarking on core modernization, banks generally choose between two broad strategies: an incremental (phased) upgrade strategy or a full system replacement. Each approach offers distinct advantages and challenges.

In practice, many large institutions lean toward incremental strategies to mitigate risk, but some have attempted—or are considering—full core replacements to leap to a next-gen platform. Below is a comparative evaluation.

Banking Modernization Pathway #1: Incremental (Phased) Modernization

An incremental approach means modernizing the core in stages rather than all at once. Banks preserve the existing core system initially, and gradually replace or upgrade components and add new layers around it. The key is a phased transition where old and new co-exist until the new system fully takes over.

Pros:

- Drastically lowers immediate risk: Modernization happens in manageable segments, reducing the likelihood of system-wide failures

- Minimal customer downtime: Core systems remain operational throughout the process, maintaining customer service levels

- Fail-fast capability: Banks can isolate issues and fix them quickly without impacting the entire system

Cons:

- Longer project duration: Incremental modernization can extend over several years, increasing exposure to evolving technology risks and shifting business priorities

- Temporary complexity: Operating old and new systems in parallel can introduce architectural complexity, integration challenges, and duplicated processes

Banking Modernization Pathway #2: Full System Replacement (Big Bang)

A full replacement means completely decommissioning the old core and migrating to a new core platform, usually in a single massive project (or tightly compressed series of steps). The bank selects a new core system (either building in-house or buying from a vendor) and converts all accounts and products to it, often with a “big bang” go-live on a chosen date when the legacy system is turned off.

Pros:

- Eliminates legacy constraints: Provides a clean slate to redesign business processes and architecture from the ground up

- Immediate access to next-gen capabilities: Enables real-time processing, agile product development, and seamless API connectivity

- Long-term cost savings: Decommissioning legacy systems and support contracts lowers operational costs over time

- Accelerated innovation: Frees up IT teams to focus on delivering new digital services instead of patching legacy code

Cons:

- Extremely high risk and cost: Often compared to “open-heart surgery” due to the potential for catastrophic failure during cut-over

- No margin for error: Any misstep in migration or configuration can lead to severe service outages or data integrity issues

- Frequent time and budget overruns

- Documented failures

Banking Modernization Pathway #3: Hybrid & Greenfield Strategies (for digital banks or smaller players)

It is worth noting that the lines between these approaches can blur. Many banks adopt a hybrid strategy – for example, running a multi-year phased migration (incremental), but with a target of eventually having a completely new core (full replacement at the end).

Vendor Landscape for Core Modernization in Banking: Leading Platforms and Technologies in 2025

A new generation of cloud-native core banking platforms has emerged, driving the future of core modernization for banking by enabling financial institutions to replace or augment their legacy core systems with scalable, flexible, and API-driven solutions.

- Temenos, a long-standing leader in core banking modernization, offers cloud-deployed core platforms that support co-existence strategies, helping banks reduce risk during their core system modernization journey.

- Finxact (now part of Fiserv) delivers an API-first, real-time core platform designed for modernizing core systems incrementally. Its architecture supports parallel deployment, enabling banks to launch new digital banking products while migrating from their existing system.

- Mambu provides a SaaS-based “composable banking” platform that leverages open APIs to accelerate product innovation. It is popular among digital challengers and traditional banks seeking to enhance operational efficiency and customer-centric services through banking modernization.

- Thought Machine’s Vault platform is a fully cloud-native, next-generation core system that offers flexible product configuration via smart contracts. Major banks like JPMorgan Chase are adopting Vault to drive core banking transformation, improve real-time processing, and support embedded finance initiatives.

These vendors empower banks to embrace digital transformation through cloud, microservices, and API-driven architectures, moving beyond the constraints of legacy core vendors. Their solutions enable financial institutions to meet evolving customer expectations, ensure regulatory compliance, and stay competitive in a rapidly changing market.

Current Tools & Technologies Driving Core Banking Modernization

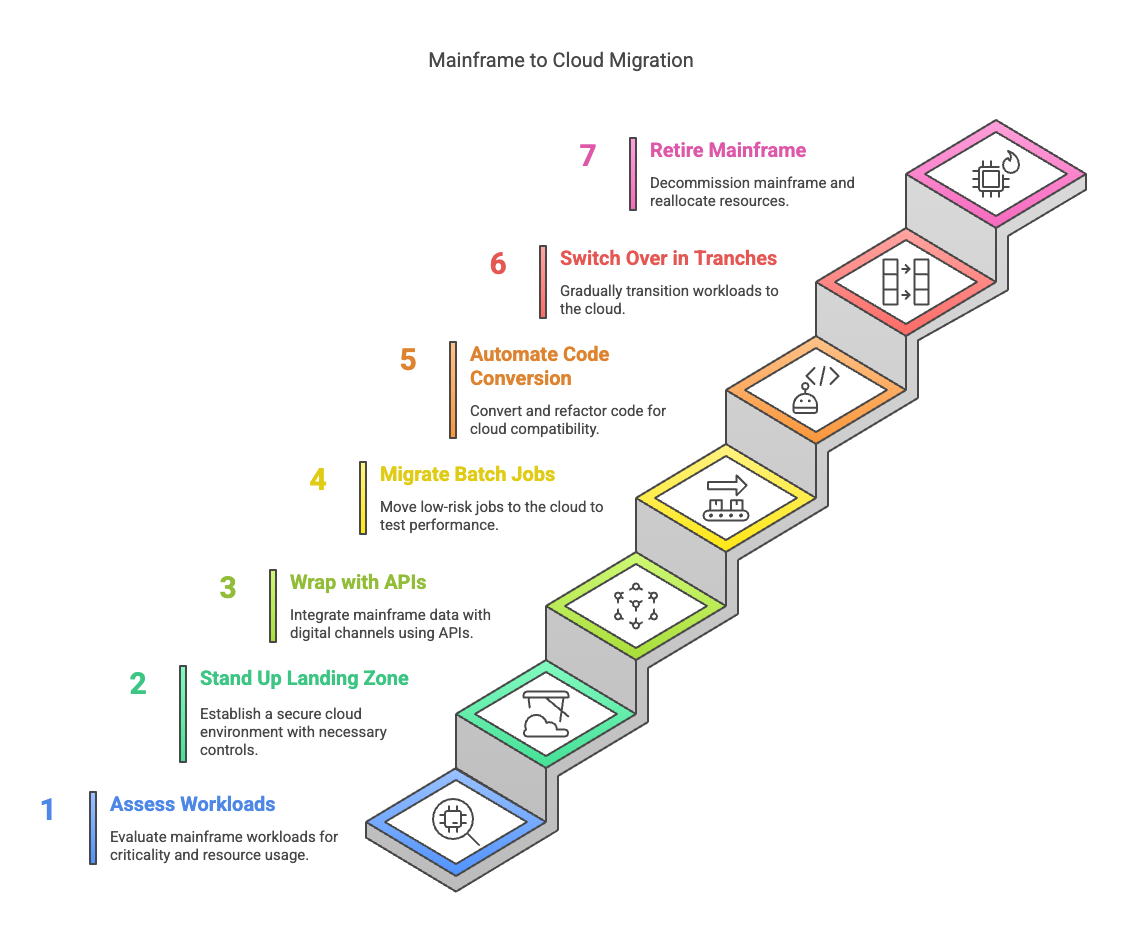

Recommended Banking Modernization Roadmap: 7 Steps to Execute with Confidence

Modernizing a core banking system isn’t a one-step project—it’s a multi-phase transformation.

This proven 7-step roadmap helps banks reduce risk, manage complexity, and unlock long-term agility.

1. Assess and Segment Legacy Workloads

Start by evaluating all existing mainframe workloads by:

- Regulatory criticality

- System coupling/interdependencies

- MIPS (Million Instructions Per Second) consumption

This helps prioritize what should migrate first and what needs deeper architectural planning.

2. Establish a Secure Cloud Landing Zone

Set up your cloud foundation in a preferred hyperscaler (e.g., AWS, Azure, GCP) with:

- PCI-DSS and SOC2 compliance baked in

- Identity, encryption, and observability guardrails in place

This becomes your staging area for modern workloads.

3. Build API Layers Around Legacy Systems

Use lightweight API gateways to:

- Wrap core services (without rewriting them yet)

- Enable real-time access to test data

- Lay the foundation for a strangler pattern architecture

4. Migrate Low-Risk Batch Jobs First

Move less critical batch processes to cloud-based emulation platforms. This allows you to:

- Validate performance

- Benchmark cost efficiencies

- Test integration pipelines without high risk

5. Convert and Refactor High-Value Code

Use automated code conversion tools to:

- Transform COBOL or legacy codebases into Java/.NET

- Refactor key stateless logic into microservices

- Make high-impact business functions portable and API-first

6. Execute Incremental Switchover by Tranches

Modernization should happen in controlled, measurable slices:

- Go live by product line, geography, or customer segment

- Run dual systems in parallel for reconciliation

- Validate each step before scaling

7. Retire the Mainframe and Reinvest Savings

Once confidence is built:

- Decommission legacy infrastructure

- Phase out proprietary support contracts

- Redirect savings toward customer experience, data innovation, or AI-driven use cases

Implementation Best Practices and Modernization KPIs for Banks

Modernization doesn’t succeed without disciplined execution. Here are five best practices—backed by measurable KPIs—to help banking leaders track progress and ensure stability.

1. Establish Strong Leadership & Governance

Create a board-level steering committee with representation from:

- IT & Architecture

- Risk & Compliance

- Operations & Customer Experience

2. Enforce Data Migration Discipline

- Conduct at least 2 full rehearsal cycles

- Require ≤ 0.01% reconciliation variance during dual-run periods

- Use structured data mapping and validation tools

3. Set Incremental KPI Targets

Track tangible progress, not just activity:

- Year 2: 20% of core transactions migrated to the new stack

- Year 4: 50% migrated with live customer traffic

- KPIs should also monitor error rates, performance, and system availability.

4. Design for Operational Resilience

Ensure:

- Zero customer-visible downtime during cutovers

- Active-active, multi-region cloud deployment for failover and latency

- Real-time incident management protocols

5. Maintain Rigorous Security Controls

Every new service or migration must be:

- Encrypted at rest and in transit

- Covered by quarterly penetration testing

- Compliant with FFIEC, OSFI, and PCI-DSS v4

Case Studies: Banks That Tackled Core Modernization

Real-world experiences of banks that have tackled core modernization provide valuable insights.

These case studies highlight the strategic moves from major banks in the U.S. and Canada, illustrating both incremental and full replacement approaches. Drawing on their financial reports, industry publications, and bank disclosures, we aim to understand their journey, challenges, and outcomes.

Zions Bancorporation

A Decade-Long Core Transformation (USA)

One of the most cited recent success stories of core modernization is Zions Bancorporation, a U.S. regional bank ($90+ billion in assets) that spent over 10 years transforming its core. Zions chose a phased replacement strategy using a new core platform (TCS BaNCS from Tata Consultancy Services), making it a marquee example of an incumbent executing a near-full overhaul in stages . Initial discussions began in 2011, and the project – dubbed “FutureCore” – was executed in three phases : first consumer loans (completed 2017), then commercial loans (2019), and finally the deposit system, which went live in 2023 . By mid-2024, Zions was able to completely retire its multiple legacy cores and run everything on the new system.

According to industry observers, it is regarded as “the first successful large-scale U.S. bank core transformation from an international core provider.” . The payoff for Zions includes having real-time access to data across the bank and confidence that they can support modern banking services going forward

However, the journey was not easy. Zions’ core project ended up taking three times longer than initially expected and went over budget . The prolonged timeline was partly due to ensuring no disruption – Zions ran old and new systems in parallel and migrated branch by branch to “mitigate risk”, and even added an extra year to integrate a new API layer before the final deposit conversion

Highlights

- Business Challenge: COBOL-based legacy systems with siloed modules created inefficiencies and long delivery cycles.

- Modernization Strategy: Phased migration using TCS BaNCS over 11 years, starting with lending, followed by treasury and deposits.

- Technology Stack: TCS BaNCS, API integration layers, parallel-run architecture.

- Implementation Highlights: Dual-run co-existence, early wins in digital onboarding.

- Outcome: Fully retired legacy systems by 2023; improved time-to-market and resiliency.

Royal Bank of Canada (RBC)

Progressive Modernization with a “Build and Partner” Strategy (Canada)

Royal Bank of Canada (RBC), one of the largest banks in Canada (and globally by market cap), offers a perspective on a large bank that carefully weighed a core replacement and chose a more incremental route. RBC’s legacy core has long been considered stable but aging, and RBC has publicly acknowledged the need to “renew legacy infrastructure to ensure ongoing resiliency” as part of its strategy . Around the mid-2010s, RBC reportedly explored a full core replacement using a vendor solution (Temenos T24 was rumored to be under consideration). However, that project did not proceed to completion, likely due to the risks and challenges encountered – a reminder that even deep-pocketed banks can find big-bang replacements daunting.

Instead, RBC shifted to a “build and partner” approach to core modernization. According to a report by RBC Capital Markets, the bank selected Infosys Finacle for its next-gen core banking platform and Volante’s VolPay for payments processing, with other components built in-house . This indicates that RBC is not doing a single wholesale rip-out, but rather introducing modern components in a calibrated way: using Finacle (a modern core system) perhaps for certain lines of business or as a parallel core, and upgrading its payments capabilities with Volante, all while internally developing API layers and services to connect it together.

RBC’s Chief Digital Officer has spoken about how the bank had to fundamentally change its way of working to become more agile and address technical debt . One of RBC’s big challenges was that its infrastructure had “several different platforms across the business” leading to inconsistent experiences and slow delivery . In response, RBC invested in an API-led integration strategy – for example, RBC’s teams have used API gateways and microservices to “unlock critical customer and financial data in siloed legacy systems” and create a unified customer view .

Highlights

- Business Challenge: Legacy U.S. platform hindered innovation and digital onboarding.

- Modernization Strategy: Progressive renovation using Finacle with API-first architecture.

- Technology Stack: Infosys Finacle, internal microservices, API gateway.

- Implementation Highlights: Deployed new onboarding services for commercial clients.

- Outcome: Improved CX, faster product rollout, enabled scalable digital services.

JPMorgan Chase

Betting on Cloud-Native Core Technology (USA)

An example of a large U.S. bank leaning toward an aggressive core modernization (albeit possibly implemented gradually) is JPMorgan Chase. In 2021, news broke that JPMorgan plans to replace its U.S. retail core banking system with Thought Machine’s Vault, a cloud-native core platform . This announcement was significant: JPMorgan is the largest bank in the U.S., and its decision was seen as a strong endorsement that cloud-based core systems are the future. According to Finextra, JPMorgan’s contract with Thought Machine aims to “move away from a legacy, siloed system to a more fluid universal platform” where all products operate in real-time on a single system . In effect, JPMorgan signaled an intent to do a full core replacement in the coming years.

However, JPMorgan’s strategy can also be viewed as phased. The bank had already collaborated with Thought Machine to launch its new digital consumer bank in the UK (Chase UK) in 2021 – that initiative allowed JPM to test the Vault core in a contained environment (the UK startup had no legacy to integrate, being new). Having proven it there, JPMorgan apparently gained confidence to extend it to the much larger U.S. operations. It’s likely JPMorgan will migrate product by product or segment by segment, rather than an overnight switch for all of Chase. In essence, they are doing a “greenfield first, then migrate” approach: use a greenfield deployment (Chase UK) to mature the new core, then plan the legacy replacement in their home market. This is a clever hybrid of incremental and full replacement – mitigate risk by piloting externally, and then execute a larger replacement with that experience in hand.

JPMorgan’s embrace of a vendor like Thought Machine also highlights the evolving technology vendor landscape(which we will analyze shortly). Big banks historically either built their own core systems or used established vendors like FIS/Fiserv. Here, JPMorgan is partnering with a fintech startup-born company, indicating how the industry is opening up to new core tech options. The move likely reflects JPMorgan’s desire for cutting-edge capabilities: Thought Machine’s platform is API-driven and highly flexible in product design, which suits a bank looking to rapidly develop modern digital offerings

Highlights

- Business Challenge: Fragmented legacy cores limited product standardization and real-time capabilities.

- Modernization Strategy: Greenfield rollout via Chase UK using Thought Machine Vault; planned U.S. expansion.

- Technology Stack: Vault Core, smart contracts, full SaaS deployment.

- Implementation Highlights: Validated new core in UK; de-risked global replacement.

- Outcome: Transition plan in progress for U.S. retail; platform consolidation expected.

- Outcome: Enabled Banking-as-a-Service, improved uptime and innovation capacity.

TD Bank

- Business Challenge: Modernizing for mobile-first customer experience while core remains legacy.

- Modernization Strategy: Incremental modernization by enhancing digital and mobile layers first.

- Technology Stack: Azure cloud services, containerized APIs, API management, mobile app refresh.

- Implementation Highlights: Focus on digital CX, added personalization and API performance.

Outcome: Strengthened digital brand, foundational work for eventual core modernization.

Bank of Montreal (BMO)

- Business Challenge: Fragmented legacy systems and product duplication across business lines.

- Modernization Strategy: Hybrid approach integrating new digital services with backend API orchestration.

- Technology Stack: Google Cloud, Apigee API Gateway, SAP core integration.

- Implementation Highlights: Streamlined product launch and omnichannel onboarding.

- Outcome: Improved developer velocity, time-to-market, and real-time reporting readiness. Problem: Legacy costs and BaaS inflexibility Solution: Big-bang migration to cloud-native cores (Finastra, Vault)

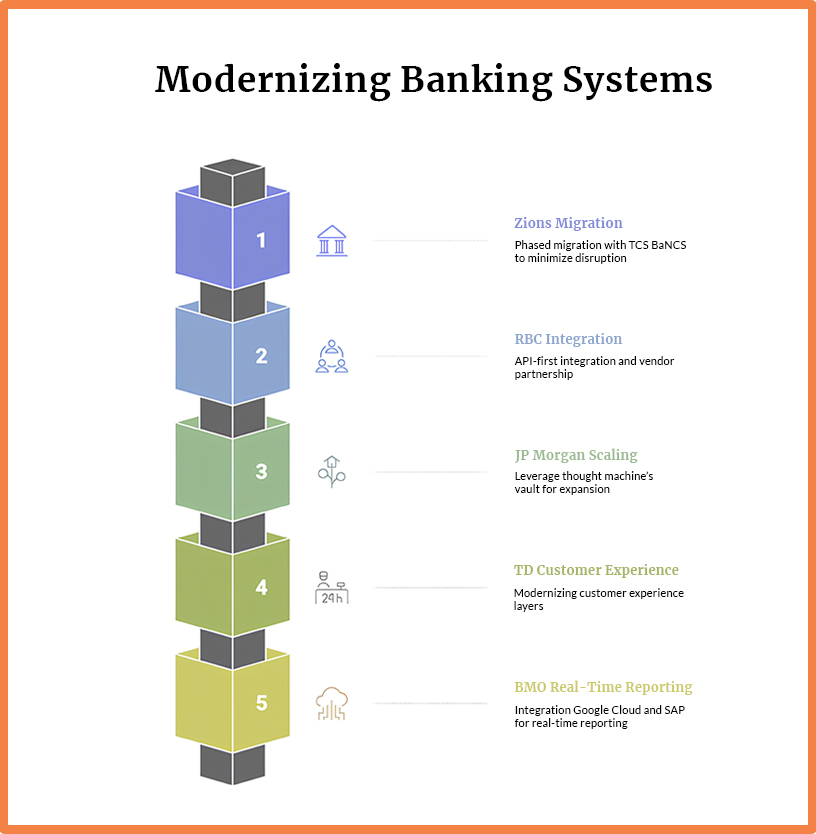

Lessons from Banking Industry Leaders

Migration

Zions Bancorporation: 10-year phased migration using TCS BaNCS with a focus on minimizing customer disruption.

Integration

Royal Bank of Canada: API-first integration and vendor partnerships for targeted modernization.

Scaling

JPMorgan Chase: Leveraged Thought Machine’s Vault in a greenfield UK bank before scaling to U.S. operations.

Customer Experience

TD Bank: Modernized customer experience layers while maintaining legacy core.

Real-time Reporting

Bank of Montreal: Integrated Google Cloud and SAP to enable real-time reporting and agile product development.

Final Takeaway: Positioning Your Bank For Next-Generation Growth

Mainframe modernization is no longer optional—it is the linchpin for unlocking real‑time banking, regulatory agility, and cost efficiency.

Whether banks choose a phased hollow‑out or a bold rip‑and‑replace, success demands an API‑first, cloud‑native mindset coupled with disciplined execution. Several tools exist today to migrate COBOL workloads, expose core capabilities as micro‑services, and ultimately converge on modern cloud cores such as Temenos, Finxact, Mambu, or Thought Machine.

Institutions that act decisively will position themselves for next‑generation growth; those that delay risk ceding digital ground to fintechs and cloud‑native challengers.