Challenges

Our client, a leading financial services provider, wanted to modernize its outdated credit card application processing system. The legacy platform was heavily manual, inconsistent across departments, and hindered both efficiency and user satisfaction. Long onboarding times, fragmented approval flows, and limited visibility into applications created operational bottlenecks that affected turnaround time and compliance readiness.

The challenge was to reimagine this system into a streamlined, automated, and scalable digital platform, one that reduced human error, accelerated approvals, and provided clear visibility to every team involved in the process.

Approach

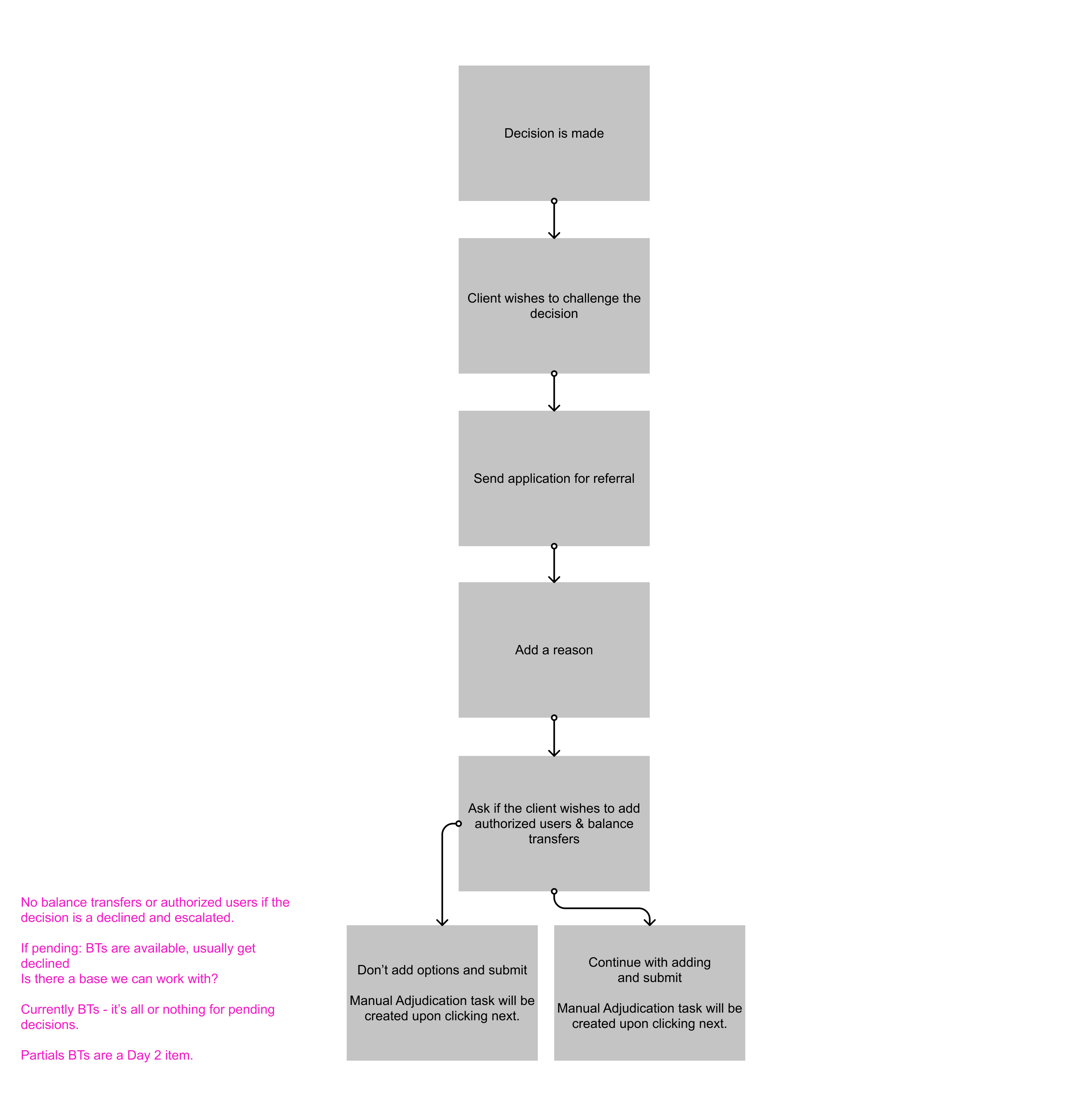

We started by mapping the end-to-end credit card application journey across multiple roles—analysts, underwriters, call center agents, and managers—to identify key pain points and inefficiencies. Through interviews and workflow observations, we discovered that each department had different tools, inconsistent data handoffs, and no shared view of application progress.

Guided by design thinking principles (Discover → Define → Design → Deliver), we defined a roadmap for transformation. The approach focused on simplifying workflows, improving transparency, and integrating automation into critical steps without disrupting existing operations.

We also recognized the importance of familiarity and trust in a regulated financial environment. The design had to feel intuitive and seamless for long-time employees while meeting new standards for compliance, scalability, and accessibility.

Solution

Research & Insights

We identified three foundational modules to anchor the redesigned experience:

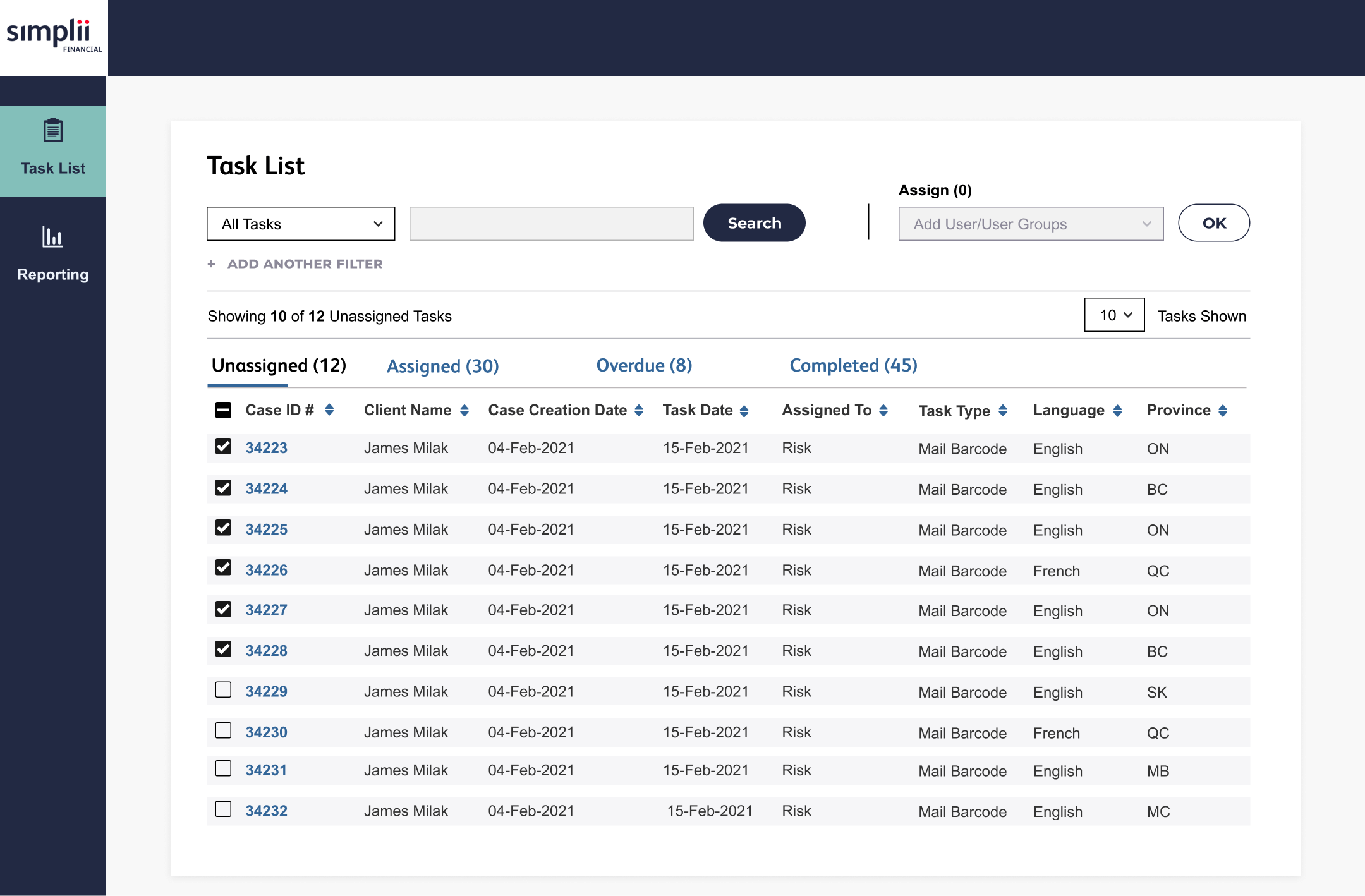

- Dashboard & Queues for real-time visibility into applications and workload management.

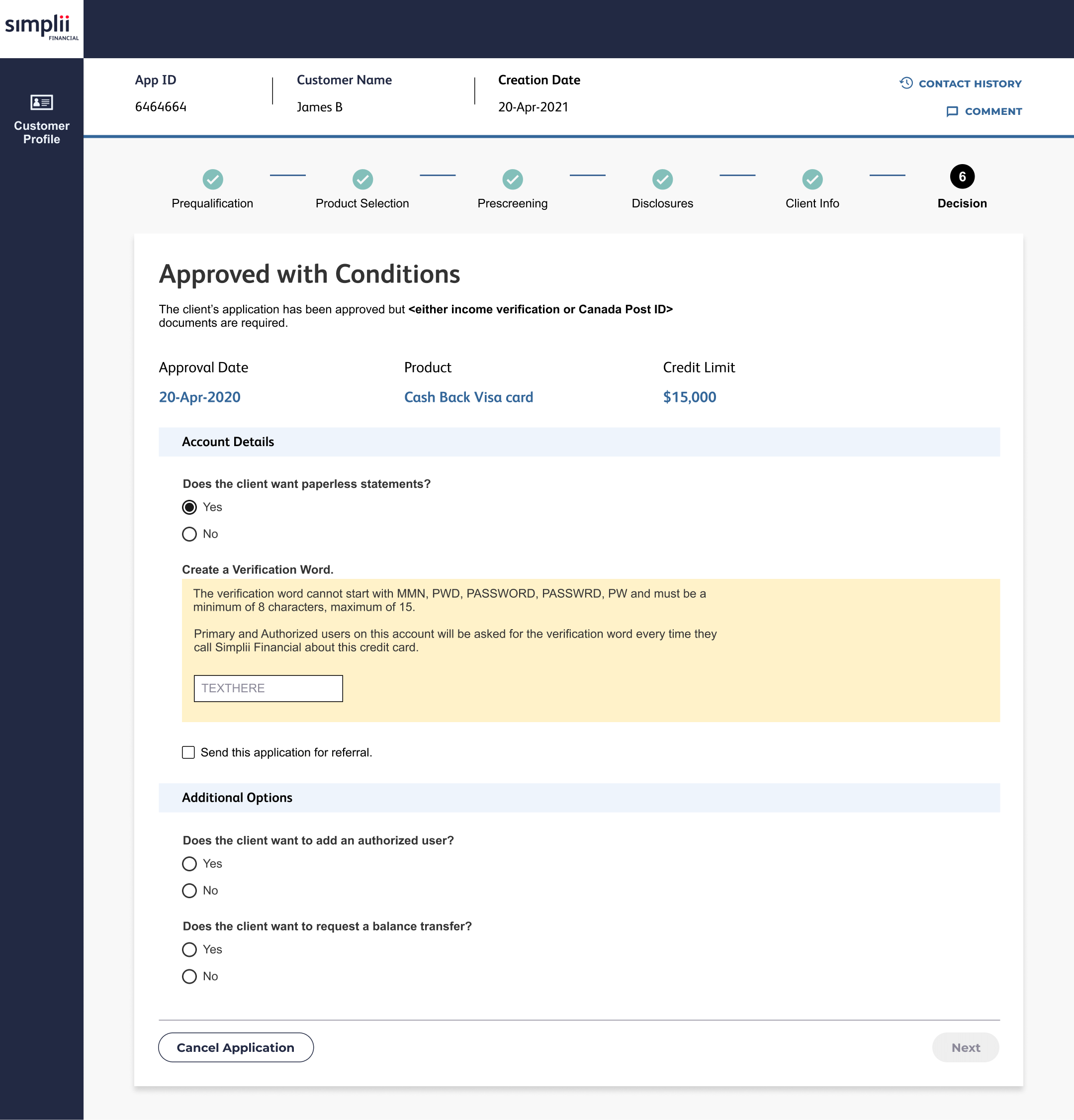

- Application Detail View to centralize applicant data, supporting quick reviews and decisions.

- Reports & Insights to track operational performance and ensure audit readiness.

Design Process

Task-based wireframes were tested with cross-functional teams to refine usability and efficiency. The high-fidelity prototypes were built in Figma using an accessible, modular component library for consistent development handoff.

Key features included:

- Role-Based Dashboards offering tailored visibility for each department.

- Progress Tracking Timeline for clear, at-a-glance status updates.

- Smart Adaptive Forms that pre-populated data to reduce manual entry.

- Unified Single-Page Layouts simplifying navigation and decision-making.

Technology & Delivery

The redesigned platform was built using scalable architecture principles, ensuring smooth integration with existing systems and future-ready adaptability. By digitizing approval flows and centralizing data, the platform achieved both compliance and operational alignment across all departments.

Success

- 45% reduction in task completion time

- 50% drop in application processing errors

- 30–40% faster overall turnaround time

- Usability score improved from 62 to 88

- Significant increase in platform adoption across teams

The transformation replaced cumbersome manual steps with automation and clarity. Teams gained better visibility into progress, compliance risks decreased, and employees could complete approvals faster and with greater confidence.

Key Takeaway:

Legacy systems can be modernized successfully when design, automation, and compliance work in harmony, delivering both operational efficiency and a superior user experience.